Bitcoin

Two Big Bitcoin Catalysts Could Drive MicroStrategy Stock Gains, Says TD Cowen

-

The price of Bitcoin could soar this month, as could shares of MicroStrategy, which holds billions of dollars worth of BTC, said an analyst at TD Cowen.

-

MicroStrategy is poised to be “significantly higher” at the end of the year, Lance Vitanza said.

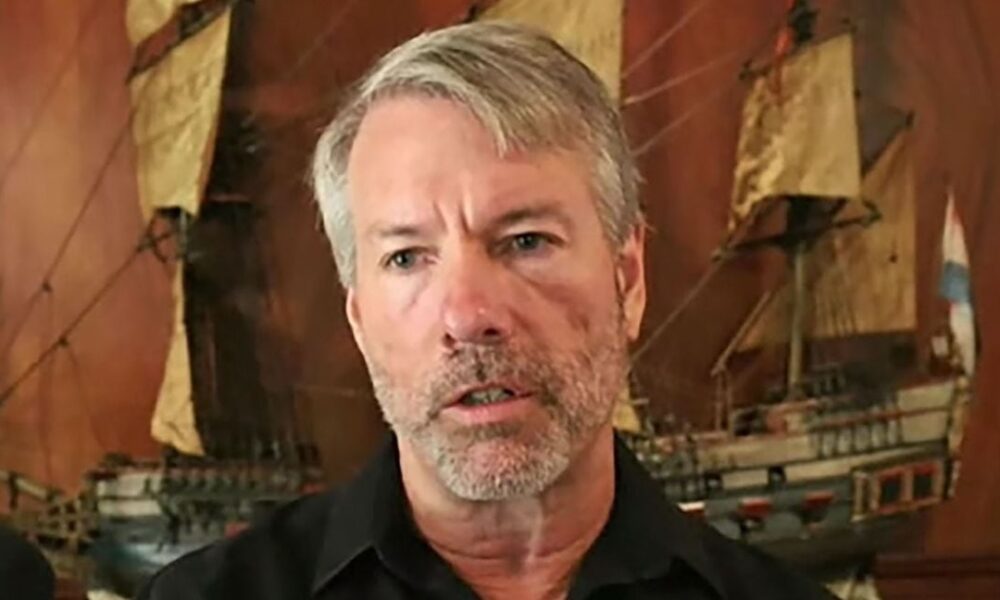

Bitcoin {{BTC}} has significant upside potential this month thanks to two major catalysts and shares of Michael Saylor’s MicroStrategy (MSTR) could also rise, on track to be “significantly higher” by the end of the year, Lance , TD analyst Cowen Vitanza said in a note on Monday.

Last week, MicroStrategy reported a net operating loss of $53.1 million for the first quarter of 2024 after taking a $191.6 million digital asset impairment charge. But the company did not adopt a new fair value accounting standard for digital assets that would have given it a considerable profit from bitcoin’s rally earlier in the year.

See more information: FASB’s Crypto Accounting Restructuring Could Attract More Corporate Investment, Argue Michael Saylor and Others

Vitanza, who participated in MicroStrategy’s World 2024 user forum in Las Vegas last week, however, said customers have had significant positive feedback regarding the company’s legacy software business, founded long before Saylor pressured the company to buy billions of dollars worth of bitcoin. “This is making us rethink the potential advantages of the operational business,” he wrote.

The company’s shares, which are up 89% year-to-date, could also see significant appreciation due to two main catalysts that could drive up the price of bitcoin.

May 15 marks the deadline for institutional investment managers to file Form 13-F with the Securities and Exchange Commission. If it is shown that more companies purchased the recently approved spot bitcoin exchange-traded funds during the first quarter, it will show that bitcoin has gained greater institutional acceptance, the analyst said.

Vitanza said another event that could be positive for bitcoin, and therefore MicroStrategy, will be the SEC’s likely rejection of an ether ETF, which many in the industry are bracing for.

“This is significant because while the fate of Ethereum may remain uncertain until 2025 or beyond, we believe there is a substantial amount of capital waiting for a digital winner to be declared; To the extent that Bitcoin proves to be the winner, incremental demand will likely be felt even more acutely due to Bitcoin’s recent halving,” Vitanza said.

Bitcoin has risen 43% since the beginning of the year and reached a new all-time high above $73,000 in March, according to data from CoinDesk. It is currently trading at $63,000.