Bitcoin

US Bitcoin ETFs Attract Over $2 Billion in Inflows in Two Weeks Amid Renewed Market Optimism

Main conclusions

- US spot Bitcoin ETFs saw strong inflows this week, with funds collectively capturing over $1 billion.

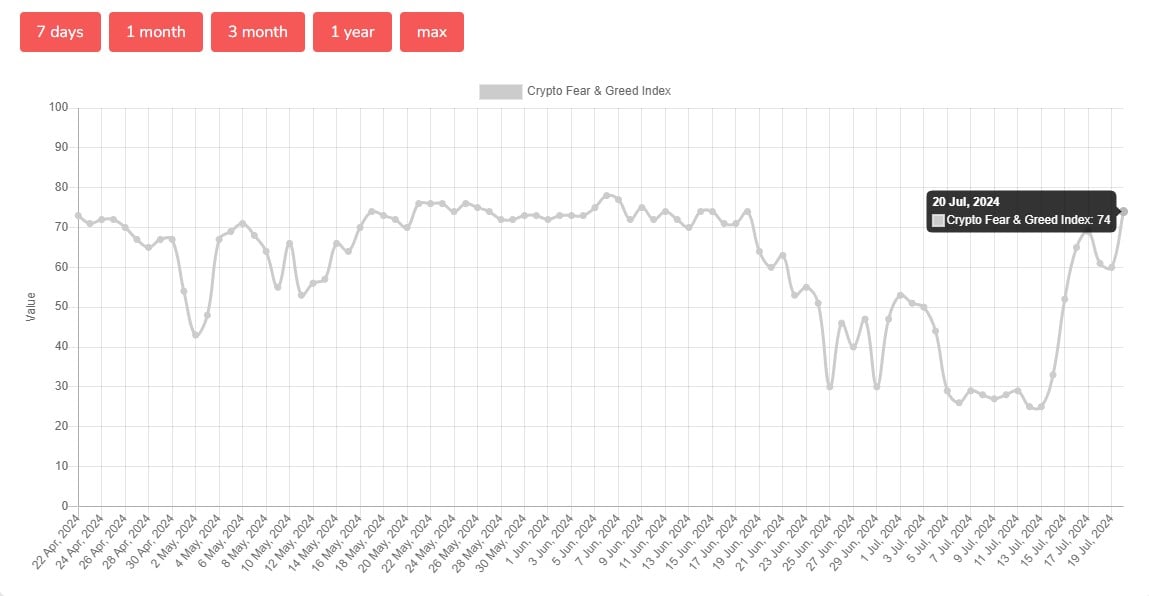

- Cryptocurrency market sentiment is turning positive, with the Cryptocurrency Fear and Greed Index reaching 74.

Share this article

US spot Bitcoin exchange-traded funds (ETFs) have attracted more than $2 billion from investors in the past two weeks amid renewed market optimism, with the Crypto Fear and Greed Index hitting its highest level since late June, according to data from SoSoValue and Alternative.eu.

(Note: ARKB’s Friday streams are not included as there were no updates observed at the time of reporting).

Data from Alternative.me shows that the Crypto Fear and Greed Index jumped 14 points to 74 on Saturday. The index’s rising score came as the price of Bitcoin (BTC) hit a high of $66,800 on Friday evening, TradingView’s data show.

Last week, the index remained in the “fear” zone. Despite the bearish market sentiment, the US spot Bitcoin ETFs Attract Over $1 Billion in entries throughout the week.

Building on this success, US spot Bitcoin ETFs continued to attract substantial inflows this week.

Bitcoin ETFs started the week on a high note with Capital of US$ 301 million flowing into the funds on Monday. These funds collectively accumulated over $1 billion in weekly inflows (excluding Friday’s flows from ARKB due to lack of update), with Tuesday witnessing the largest daily inflow input of more than 422 million dollars.

This week alone, BlackRock’s IBIT led the pack with about $706 million in inflows, according to data from SoSoValue and Farside.

IBIT inflows have surpassed $1.2 billion over the past two weeks, accounting for 50% of total inflows into eleven spot funds during that period. The fund remains the largest Bitcoin spot ETF, with nearly $22 billion in assets under management (AUM) as of July 19.

Fidelity’s FBTC saw approximately $244 million in inflows this week, while Bitwise’s BITB reported over $70 million. Other gains were also seen in ARK Invest’s ARKB, VanEck’s HODL, Invesco’s BTCO, Franklin Templeton’s EZBC, Valkyrie’s BRRR, and WisdomTree’s BTCW.

Despite more than $20 million in net inflows reported on Friday, Grayscale’s GBTC saw about $56 million in outflows.

With Friday’s gain (excluding ARKB), these ETFs have seen sustained inflows for eleven consecutive trading days.

Share this article