Bitcoin

US Bitcoin Strategic Reserve to be funded in part by Fed’s gold revaluation, bill shows

-

The purchase of bitcoin for a new strategic reserve would be funded in part by the Federal Reserve’s gold revaluation, according to the bill from U.S. Sen. Cynthia Lummis’ office.

-

The plan proposes to establish a “Bitcoin Purchase Program” of up to 200,000 BTC per year over a five-year period.

U.S. Sen. Cynthia Lummis’ plan for a new Bitcoin Strategic Reserve would fund purchases of the cryptocurrency in part by revaluing gold certificates held by the Federal Reserve System, according to a draft of the legislation obtained by CoinDesk.

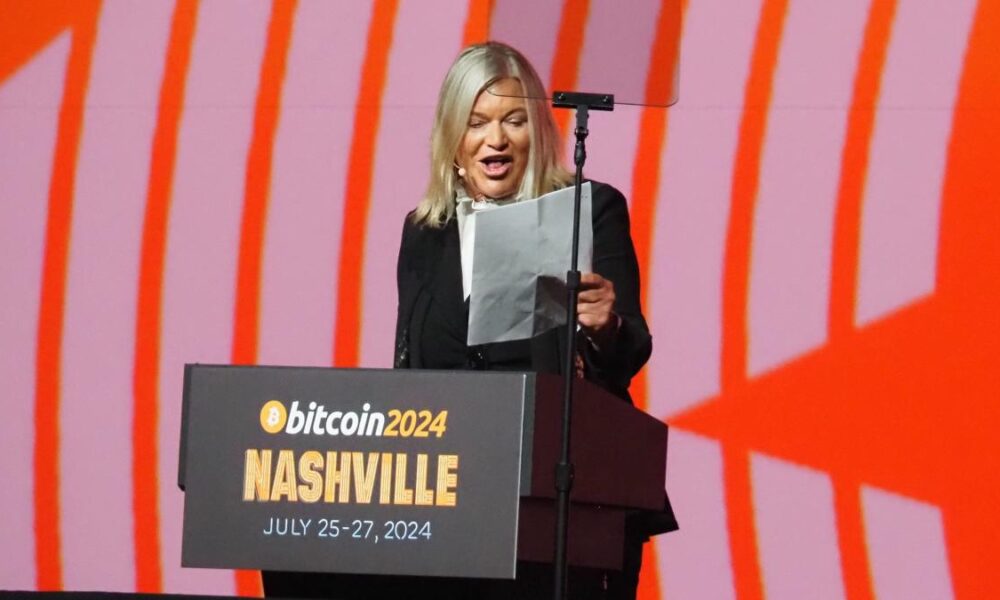

Lummis, a Wyoming Republican known for her pro-Bitcoin political stance, announced her intention to propose the reserve on Saturday at the Bitcoin Nashville conference. She took the stage just minutes after former U.S. President Donald Trump, the Republican nominee in this year’s presidential race, delivered a speech on blockchain policy to a packed 8,500-person crowd.

Read more: The US government may start accumulating Bitcoin, but how and why?

Trump, during this speech, endorsed using the U.S. government’s existing bitcoin assets—obtained primarily through forfeitures and seizures related to criminal cases—to form the “core” of a new “strategic national stockpile of bitcoin.”

According to the bill, under the working title “Bitcoin Act of 2024,” the Treasury Secretary would “establish a decentralized network of secure Bitcoin storage facilities distributed across the United States,” selecting the locations for the vaults “based on a comprehensive risk assessment, prioritizing geographic diversity, security, and accessibility.”

The Treasury secretary would establish a “Bitcoin Purchase Program” of up to 200,000 BTC per year over a five-year period, for a total of 1 million, according to the draft. The bitcoin would be held for at least 20 years and could only be disposed of for the purpose of paying off federal debt. After that, no more than 10% of the assets could be sold during any two-year period.

Bitcoin purchases would be funded through a number of methods, described in the bill as “offsetting the cost of the Bitcoin Strategic Reserve.”

The plan calls for setting aside $6 billion of any net profits remitted by the Federal Reserve to the Treasury from fiscal years 2025 through 2029, and would reduce the discretionary excess funds of Federal Reserve banks from $6.825 billion to $2.4 billion, the level currently set forth in the Federal Reserve Act.

The story continues

Revaluing the Fed’s Gold

There is also the revaluation of Federal Reserve Banks’ gold certificates to reflect their fair market value.

Under the plan, within six months of the legislation’s enactment, the Federal Reserve banks would tender all of their outstanding gold certificates to the Treasury secretary. Within 90 days thereafter, the Treasury secretary would issue “new gold certificates to the Federal Reserve banks that reflect the fair market price of gold.”

The Federal Reserve banks would then “remit the difference in cash value between the old and new certificates” to the Treasury Secretary.

Read more: Anthony Pompliano: Bitcoin will be on US balance sheet for ‘next 10, 15 years’

On July 24, Federal Reserve banks held “stocks of gold” valued at US$11 billionaccording to the most recent update of the central bank’s balance sheet.

This assessment can be based on the official US book value of $42.22 per troy ounce, which the The Federal Reserve Bank of New York uses to value its gold.

But gold’s market value is more than 50 times higher, with front-month futures contracts on the yellow metal trading at around $2,400, based on MarketWatch Pricing.