Bitcoin

US government launches new attempt to collect data on Bitcoin mining electricity usage

The fast-growing cryptocurrency industry is a major consumer of electricity, but no one — not even the U.S. government — knows exactly how much energy goes into the armada of computers used to “mine” Bitcoin and other digital assets. The U.S. Energy Information Administration estimates that cryptocurrency mining uses between 0.6% and 2.3% of all electricity annually, but the agency may soon be able to access more precise data.

In the coming months, the EIA is planning to release a draft of a new survey that would require disclosure from companies in the cryptocurrency mining industry. On Wednesday, during a “listening session”, EIA officials described the process of creating the survey, which is typical of how EIA collects energy consumption data from manufacturers and commercial buildings.

“Most of the time for us, we’re just re-approving research, so it’s usually not very controversial. That may not be true this time,” said Stephen Harvey, a senior adviser to the EIA administrator who facilitated the webinar discussion.

This marks the government’s second attempt to figure out exactly how much energy cryptocurrency mining uses. Earlier this year, amid power shortages in the dead of winter, the administration sent out an emergency survey to assess the energy footprint of Bitcoin mining.

Find out the latest on what’s at stake for the climate during this election season.

But a federal judge in Texas blocked the data acquisition following a lawsuit from Colorado-based Bitcoin firm Riot Platforms and the nonprofit Texas Blockchain Council. The lawsuit argued that rushing the research in an emergency violated the Paperwork Reduction Act of 1980, and that some of the data requested was proprietary information. Instead of an emergency authorization, the new research will be published online in the Federal Register, go through a standard 60-day public comment period and be reviewed before needing final approval from the federal Office of Management and Budget.

Bitcoin, the largest and best-known cryptocurrency, is managed by a decentralized network of Bitcoin users. A network algorithm assigns each transaction a unique random identification code, which Bitcoin “miners” derive by operating powerful banks of computers day and night, running endless series of random numbers to crack these codes.

Once a correct code is reached, confirming a transaction, which happens on average on the network every 10 minutes, a Bitcoin miner receives 3,125 newly minted Bitcoins (each worth almost $58,000). The payment goes towards helping maintain the network and keeping it secure.

The energy consumed by data centers has come under increasing scrutiny as a surge in electricity demand, fueled by both artificial intelligence and cryptocurrency mining, conflicts with U.S. emissions reduction goals. For example, Texas has the highest concentration of Bitcoin mines, some of which are extracting energy directly from fossil fuel power plants.

In Texas, Bitcoin mining facilities are major players in the energy market, able to profit in ways that go beyond their energy-intensive calculations. After locking in low rates to buy electricity, they can make sizable profits by selling power at higher rates on the wholesale market at times of peak demand and by participating in so-called “demand response” programs in which they receive a premium for allowing grid operators to reduce the power demands of Bitcoin mines when power is needed elsewhere. In these cases, the cost of the premiums paid to Bitcoin mines is passed on to Texas consumers.

Peak electricity demand on the state’s main power grid could nearly double by 2030, with cryptocurrency mining accounting for the bulk of the roughly 43,000 megawatts of large loads expected to connect to the grid in the next three years, according to estimates from the Electric Reliability Council of Texas.

However, even grid system operators like ERCOT are uncertain about how much of their energy consumption is coming from cryptocurrencies. While Bitcoin miners feel their industry is being unfairly singled out by the EIA, critics of the largely unregulated industry see transparency as a critical step to ensuring the grid remains reliable in the transition to decarbonized energy systems.

“Utilities and anyone who relies on reliable, affordable electricity should support EIA’s effort to bring transparency to this energy-intensive sector,” said Caroline Weinberg, senior research and policy analyst at the environmental law nonprofit Earthjustice.

Calls for transparency have also come from neighbors who live near Bitcoin mining areas and are concerned about a range of issues, including noise pollution and rising residential electricity rates.

“These companies work behind closed doors, in secret, to set up shop in unsuspecting communities,” said Jackie Sawicky, a founding member of the Texas Coalition Against Cryptomining. “They know that if they are honest about their operations, they won’t be let in by the general public.”

During the public comment section of the EIA briefing on Wednesday, Bitcoin mining advocates suggested that the survey should cover data centers as a whole, rather than focusing solely on cryptocurrency. In addition to cryptocurrency mines, the data center universe includes large, continuously operating computer networks needed for cloud computing and other large data storage needs, as well as AI workloads.

“The industry will be skeptical if traditional data centers are left out of the research,” said Jayson Browder, senior vice president of government affairs at Bitcoin mining company Marathon Digital.

Lee Bratcher, president of the Texas Blockchain Council, suggested that a survey covering all data centers could distinguish between traditional data centers that don’t shut down completely and “flexible” Bitcoin mines that can more easily shut down when needed, such as when electricity prices rise.

This story is funded by readers like you.

Our nonprofit newsroom provides award-winning climate coverage at no cost and without advertising. We rely on donations from readers like you to keep going. Please donate now to support our work.

Bratcher and others said that by being sensitive to electricity prices, Bitcoin miners actually improve the reliability of the network.

Alongside the EIA’s efforts, researchers have been trying to gather energy data from cryptocurrency miners as well as other data centers. “We can definitely learn a lot by looking specifically at cryptocurrency data centers,” Margot Paez, a doctoral student researching Bitcoin at Georgia Tech University, told Inside Climate News after giving public testimony to the EIA earlier Wednesday.

Accurate data showing the flexibility of Bitcoin mining, Paez said, could help inform how all data centers could operate more efficiently. During his remarks, Paez suggested that the EIA work with Georgia Tech and Lawrence Berkeley Lab on ongoing efforts to gather the same data, saying that Bitcoin companies may feel more comfortable working with academic researchers than working directly with the government.

She added in an interview that from her conversations with industry, companies are “starting to see that this kind of research can help them as well.”

Bitcoin

‘This is huge’ — Billionaire Mark Cuban issues ‘incredible’ Bitcoin and crypto prediction amid price slump

Bitcoin has surged again this year under former President Donald Trump Cryptocurrency boosts US presidential election in November with ‘revolutionary’ plan.

The price of bitcoin has surged to more than its all-time high in recent months, surpassing $70,000 per bitcoin and triggering a wave of mega-optimistic predictions about the price of bitcoinalthough it fell again this week to below $65,000 after the Federal Reserve kept interest rates steady.

Now, as Elon Musk suddenly breaks his silence on bitcoin and cryptocurrenciesBillionaire investor Mark Cuban called a California plan to digitize 42 million car titles using blockchain an “incredible step forward” and “huge” for cryptocurrencies.

Sign up for free CryptoCodex now—A daily five-minute newsletter for traders, investors, and crypto curious people that will keep you up to date and ahead of the bitcoin and crypto bull market

Mark Cuban, famous Shark Tank investor and billionaire owner of the NBA team Dallas Mavericks, has… [+] called a cryptocurrency update “amazing” amid bitcoin’s price slump.

Getty Images

The California Department of Motor Vehicles (DMV) has digitized 42 million car titles using blockchain, it was reported by Reuters, through technology company Oxhead Alpha on the Avalanche blockchain and designed to detect fraud and facilitate the securities transfer process.

“This is an incredible development for crypto,” Cuban, best known as an investor on TV’s Shark Tank and owner of the Dallas Mavericks NBA team, posted on X, joking that U.S. Securities and Exchange Commission (SEC) Chairman Gary Gensler could sue the state as part of his hostility toward cryptocurrencies and blockchain technology.

“The reason this is huge for crypto is because people who hold the tokens will have an app with an Avalanche wallet,” Cuban said. “Tens of millions of Californians having and using a crypto wallet in the next five years, or however long it takes, normalizes the use of wallets and crypto.”

John Wu, president of Avalanche developer Ava Labs, told Reuters that California’s DMV is “creating a wallet that you can download on your phone.”

Sign up for CryptoCodex now—A free daily newsletter for the crypto-curious

Bitcoin’s price has rallied this year, triggering a wave of bullish bitcoin price predictions from… [+] people like billionaire Mark Cuban.

Forbes Digital Assets

Last month, Cuban predicted that if the US dollar falls as the global reserve currency, bitcoin could become “a global ‘safe haven’” and a “global currency.” potentially sending the price of bitcoin to a much higher level.

According to Cuban, bitcoin could become what its most ardent supporters “envision” — a means “of protecting our economies… This is already happening in countries facing hyperinflation.”

The price of bitcoin has skyrocketed over the past year, largely due to the world’s largest asset manager, BlackRock, leading a bitcoin attack on Wall Street.

Bitcoin

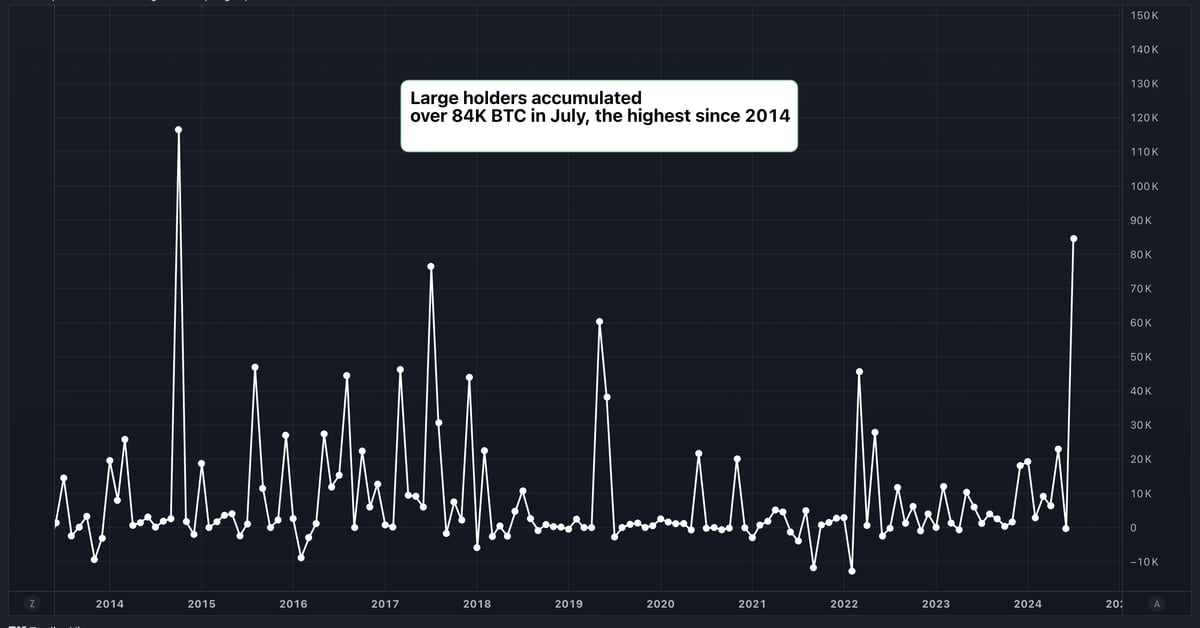

Large Bitcoin (BTC) Holders Added $5.4 Billion Worth of BTC in July, Data Shows

Please note that our Privacy Policy, terms of use, cookiesIt is do not sell my personal information Has been updated.

CoinDesk is a awarded media outlet that covers the cryptocurrency industry. Its journalists follow a strict set of editorial policies. In November 2023, CoinDesk has been acquired by the Bullish group, owner of Optimistica regulated digital asset exchange. The Bullish Group is majority owned by Block.one; both companies have interests CoinDesk has a portfolio of blockchain and digital asset businesses and significant holdings of digital assets, including bitcoin. CoinDesk operates as an independent subsidiary with an editorial board to protect journalistic independence. CoinDesk employees, including journalists, may receive options in the Bullish group as part of their compensation.

Bitcoin

Peter Schiff criticizes Michael Saylor’s Bitcoin hype by U.Today

U.Today – Renowned economist and cryptocurrency critic Peter Schiff has criticized Michael Saylor’s recent hype about the growing adoption of cryptocurrencies as a strategic treasury asset by corporations.

Michael Saylor, a well-known Bitcoin advocate and president of MicroStrategy, recently shared his enthusiasm on X about the growing adoption of Bitcoin as a strategic treasury asset.

Citing a comment made by Bitcoin investor Bill Miller in a recent interview with CNBC, Saylor tweeted: “We now have more companies coming forward and saying we will put Bitcoin on our balance sheet as a strategic treasury asset.”

However, not everyone shares Saylor’s enthusiasm. Schiff, a vocal Bitcoin critic and gold bull, was quick to respond with his usual skepticism. In a pointed tweet, Schiff argued: “Bitcoin is neither strategic nor appropriate as a treasury asset. Companies should not risk shareholder funds. They should pay dividends and let shareholders risk their own money.”

Bitcoin enthusiasts are not intimidated

However, Schiff’s criticism shouldn’t deter Bitcoin enthusiasts, who often take Schiff’s words with a pinch of salt. To put things in context, Michael Saylor began buying Bitcoin in 2020 as an inflation hedge and alternative to money. Saylor’s company, MicroStrategy, is among the largest public holders of Bitcoin in the world. As of June 20, it held 226,331 BTC, purchased for around $8.33 billion at an average price of $36,798.

Over the weekend, Schiff was surprised when 87% of the more than 11,000 Bitcoin holders who responded to his X survey said they would not sell any of their Bitcoin even if the price dropped more than 99% to $120. They said not only would they not sell, but that they would continue to buy even when prices dropped.

Schiff unexpectedly revealed that “the main selling point for investors to buy Bitcoin is its excellent past performance record.”

At the time of writing, Bitcoin is trading at $66,067, having reached all-time highs of nearly $74,000 in mid-March.

Bitcoin

Bitcoin Falls as ETF Flows Reverse, Mt. Gox Moves Billions

In a week of drastic fluctuations, the price of Bitcoin (BTC) has retreated from its highs and is currently trading at US$66,250, down 0.9% in European trading.

This volatility comes on the heels of a significant surge above $70,000 earlier in the week, fueled by former President Donald Trump’s ambitious cryptocurrency plans announced in a Bitcoin Conference in Nashville.

Trump’s announcement to fire Securities and Exchange Commission Chairman Gary Gensler and establish a strategic Bitcoin reserve if elected president has temporarily sent the cryptocurrency market into a frenzy.

However, the excitement was short-lived as a series of events unfolded which caused investor sentiment to sour.

A significant sell-off of about 8% was triggered when the US Marshals Service moved $2 billion in Bitcoin for new wallets.

This move has reignited fears of a potential large-scale liquidation, compounded by lingering concerns over a possible Bitcoin liquidation from Mt. Gox. Early this morning, Mt. Gox administrator transferred US$2.2 billion value of your BTC assets in a new wallet.

Meanwhile, the US Bitcoin ETF spot market is showing signs of fluctuation, according to data from SoSo Value. On July 30, Bitcoin spot funds experienced their first net outflow in five days, totaling $18.3 million.

The Grayscale Bitcoin Trust (GBTC) saw outflows of $73.6 million, while the BlackRock iShares Bitcoin Trust (IBIT) attracted $74.9 million in inflows. But outflows from other funds left the category in the red at the end of Tuesday’s trading session. The total net asset value of spot Bitcoin ETFs currently stands at a substantial $58.5 billion.

In other crypto news, Ripple (XRP) is up 8.6% in the past 24 hours, hitting over 64 cents – its highest point since March 25, according to CoinGecko. data.

This rally comes amid a scheduled token unlock and growing optimism around a potential deal in the long-running SEC vs. Ripple lawsuit.

The crypto community is closely watching the SEC’s actions, particularly its intention to amend its complaint against Binance regarding “Third-Party Cryptocurrency Securities,” which some interpret as a positive sign for Ripple.

On a market analysis noteSingapore-based cryptocurrency trading desk QCP Capital wrote that while election headlines continue to dominate, several crucial macroeconomic events loom on the horizon.

“Election headlines will continue to be a key focus, but several key macroeconomic events are also on the horizon. Key events starting with the FOMC meeting on Wednesday, megacap tech earnings (Apple, Amazon, Meta) throughout the week, and unemployment data on Friday,” QCP Capital wrote.

Edited by Stacy Elliott.

-

Regulation7 months ago

Regulation7 months agoRipple CTO and Cardano founder clash over XRP’s regulatory challenges ⋆ ZyCrypto

-

Regulation5 months ago

Regulation5 months agoNancy Pelosi Considers Supporting Republican Crypto Bill FIT21 – London Business News

-

Videos6 months ago

Videos6 months agoCryptocurrency News: Bitcoin, ETH ETF, AI Crypto Rally, AKT, TON & MORE!!

-

Regulation6 months ago

Regulation6 months agoBitcoin’s future is ‘bleak’ and ripe for regulation, says lead developer

-

News6 months ago

News6 months agoThe trader earned $46 million with PEPE after reaching a new ATH

-

Blockchain6 months ago

Blockchain6 months agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Blockchain6 months ago

Blockchain6 months agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto

-

Regulation6 months ago

Regulation6 months ago🔒 Crypto needs regulation to thrive: Tyler Cowen

-

Videos6 months ago

Videos6 months agoWho Really CONTROLS THE MARKETS!! Her plans REVEALED!!

-

Videos7 months ago

Videos7 months agoKucoin safe?? Exchange REVIEW and beginner’s guide!!

-

Blockchain6 months ago

Blockchain6 months ago“Liquid vesting” is an oxymoronic feature of blockchain that allows early investors to sell without waiting

-

Videos6 months ago

Videos6 months agoInstitutions purchasing MEMECOINS?! Everything you need to know!