Ethereum

Volatility Ahead Amid Increasing ETH Selling Pressure

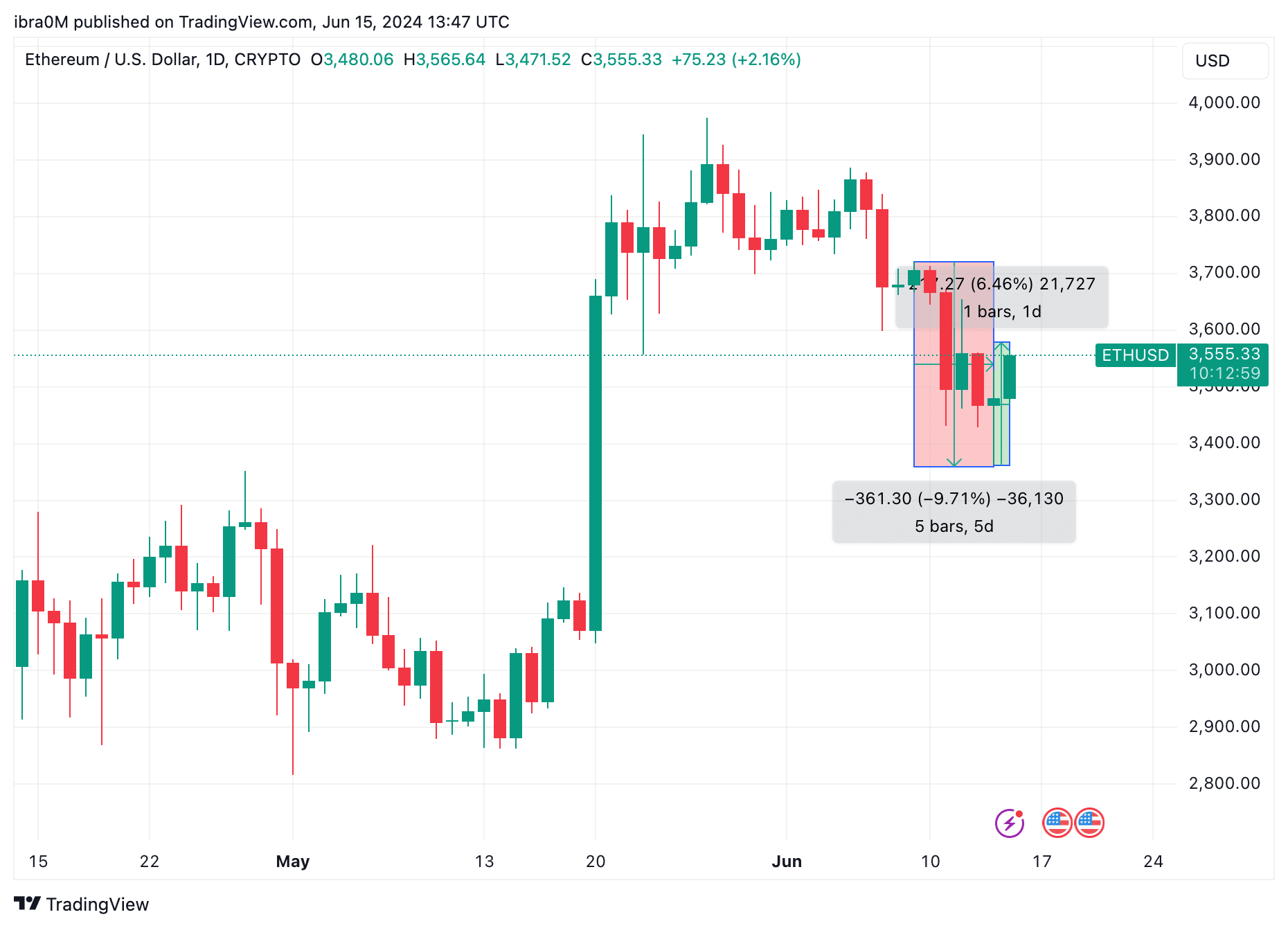

Ethereum price quickly fell to a 25-day low of $3,428 on June 13, 2024, amid intense volatility following the US Fed’s rate pause announcement; on-chain data trends suggest more downsides to come.

Ethereum Price Falls Below $3,500 for First Time Since ETF Approval

The crypto market has been in a consolidation phase for most of the past month. During this period, ETH managed to outperform the market average thanks to tailwinds resulting from the approval of the ETF by the US SEC in late May.

However, three weeks after the official approval verdict, the fund’s sponsors are still stuck making final adjustments to filings before the fund’s official listing. Ethereum AND F.

After another week of little progress, with no provisional listing date in sight, investors now seem to be growing impatient. This led to a significant drop in prices on June 14, after the US Fed announced a hawkish rate pause, ending hopes of a cut in the first half of 2024 as many bullish analysts had predicted.

As noted above, the price of ETH fell by 9.71% in the weekly time frame, giving up most of the gains gained following the ETF approval. The chart shows that ETH fell towards $3,362 on June 14, before rebounding towards the $3,550 mark at the time of writing on Saturday, June 15.

But notably, the last time ETH price traded below $3,400 was on May 21, before the rally that greeted the news of the de facto approval of the ETH ETF announced by Bloomberg analysts. This shows that delays surrounding the official launch of ETFs had a negative impact on demand for Ethereum this week, increasing the risk of a further price decline.

Selling pressure from long-term ETH holders increases by 10%

Clearly, the recent Ethereum market demand is now in decline as the bulls have grown tired amid the 3-week break around the official launch of the ETH ETF.

However, looking at on-chain data, recent activity among existing ETH holders shows that the market volatility may not be over yet.

Santiment’s Mean Coin Age data tracks the average number of days that all ETH coins in circulation have spent at their current addresses. A decline in average coin age occurs when a large number of long-term holders are actively selling, and vice versa.

The chart above illustrates how ETH Mean Coin Age (365d) has seen a rapid decline since May 29 as it became clear that the launch of Ethereum ETFs would take weeks after the official SEC verdict on May 24 .

Between May 29 and the June 15 publication date, the average age of Ethereum coins decreased by 10%, from 172.23 to 164 average days of holding.

Such a significant drop over a short period shows a growing selling trend among long-term Ethereum investors who had previously held their coins immobile for a year or more. This suggests that they sold their coins behind the scenes, taking advantage of the price surge following the ETF approval.

With a significant number of coins stuck for over a year, the price of ETH is likely to see more volatility in the days to come.

Disclaimer: This content is informational and should not be considered financial advice. The opinions expressed in this article may include the personal opinions of the author and do not reflect the opinions of The Crypto Basic. Readers are encouraged to conduct thorough research before making any investment decisions. Crypto Basic is not responsible for any financial losses.

-Advertisement-