News

What the data really shows

Few platforms have faced as much skepticism as Solana. Critics often describe it as a centralized network plagued by frequent outages. However, that narrative does not align with the actual data and progress witnessed within the Solana ecosystem. This article seeks to dispel these misconceptions by comprehensively analyzing Solana’s key parameters.

Contrary to the prevailing negative perception, Solana shows remarkable growth and innovation on multiple fronts. The growing volumes of stablecoins traded on its network and larger decentralized exchange (DEX) volumes compared to Ethereum highlight Solana’s expanding utility. Additionally, the platform’s superior data rate showcases its technical capabilities and resilience. Additionally, the surge in new addresses and daily active users further reflects the growing trust and adoption among the broader crypto community.

By examining these metrics, this article aims to provide a balanced, data-driven perspective on why Solana is an undervalued asset in the cryptocurrency market as of June 2024.

Centralization

The decentralization of a blockchain network is complex and cannot be evaluated simply on one metric. An in-depth look at how the network is truly decentralized based on every detail could fill an entire article. Therefore, we will focus on the Nakamoto coefficient. The Nakamoto coefficient measures the minimum number of entities in a network needed to collude to disrupt the system. For proof-of-stake networks like Solana and Ethereum, a 33% share is significant, while for proof-of-work networks like Bitcoin, 51% control is crucial.

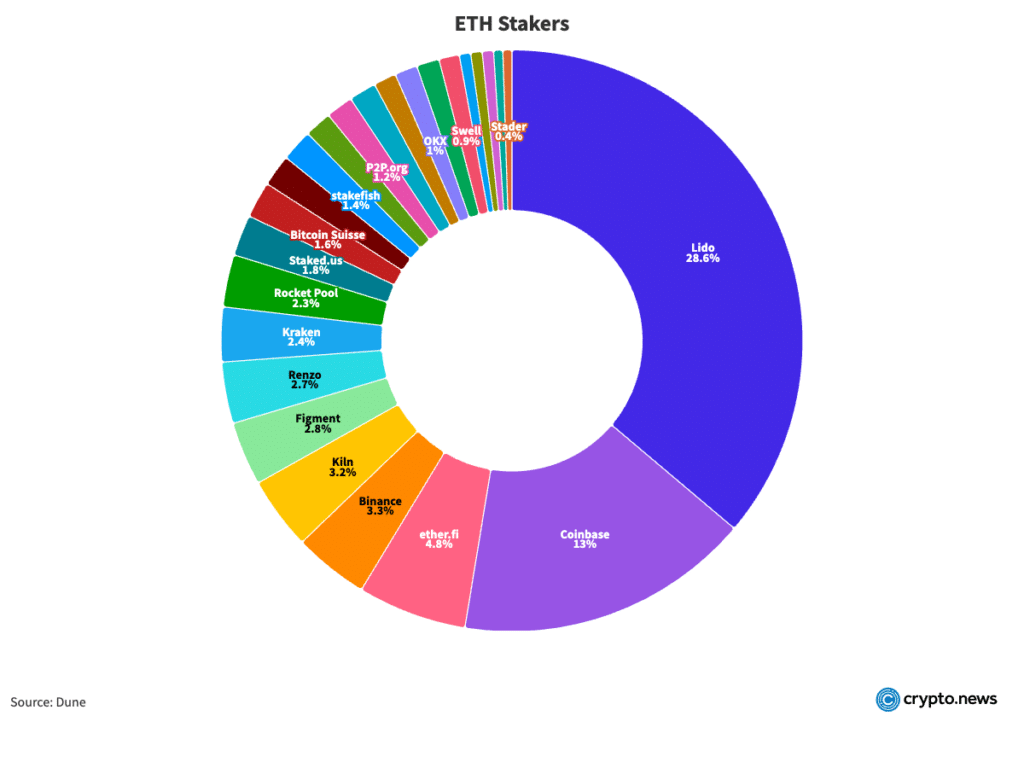

As of June 20, 2024, Solana has 1,525 active validators, including 20 holding more than 33% stake. On the other hand, Ethereum has 1,024,619 active validators, with only two entities controlling more than 33% of the stake. A validator must stake 32 ETH to become a node on the Ethereum network. The problem here is that one entity can control multiple validators, masking the actual level of decentralization.

Active validators and Nakamoto coefficient, June 20, 2024

Second Dune, Lido and Coinbase hold over 33% stake in Ethereum. If each node contains 32 ETH, then of the 1,024,629 active nodes, these two entities potentially control 432,389 unique validators. This concentration of control under two entities undermines the ethics of decentralization.

ETH Stakers Pie Chart, June 20, 2024

For Bitcoin, the network has 17,692 full nodes that have not been pruned, of which 7,516 are capable of disrupting the network. Unfortunately, there is no information about the individual hashrate of each node. The Peer Index (PIX) was used to calculate this number. The PIX value, ranging from 0.0 to 10.0, updates every 24 hours based on node properties and network parameters, with 10.0 being the most desirable. Nodes with a PIX value equal to or greater than 5 were considered.

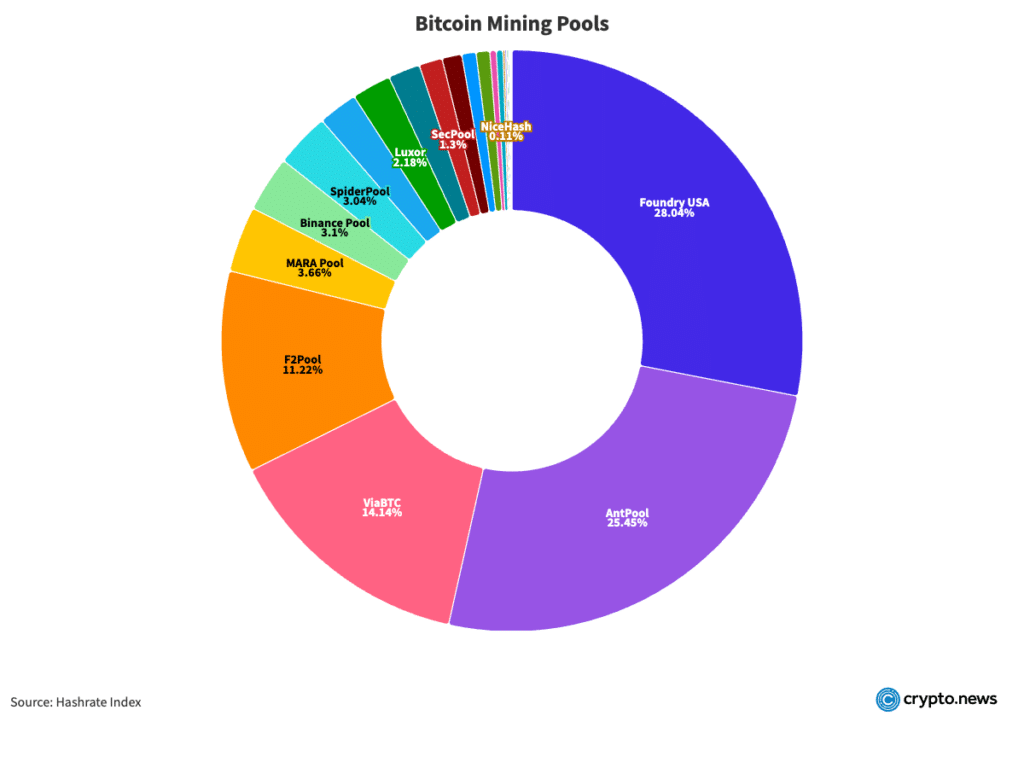

Some may argue that Bitcoin’s decentralization should be assessed through hashrate distribution. Currently, two mining poolsFoundry USA and Antpool, control over 51% of the network’s hashrate.

Bitcoin Mining Pools Pie Chart, June 20, 2024

However, it is incorrect to consider these pools as the controllers of the network because they are pools of individual miners. Mining pools allow miners to combine their computational resources to increase their chances of solving blocks and earning rewards. If a pool begins to act maliciously, individual miners can simply switch to a different pool, maintaining the decentralization of the network.

Although the decentralization of blockchain networks is multifaceted and cannot be accurately assessed by a single metric, the Nakamoto coefficient provides a useful lens for comparison. Solana’s position is not as worrying as it might initially seem. With a Nakamoto coefficient indicating that 20 validators hold more than 33% of the share, Solana appears more decentralized than Ethereum, where only two entities hold more than 33% of the share. Furthermore, even though Solana is not as decentralized as Bitcoin, it still maintains a solid level of decentralization, contributing to its security and reliability.

Stability

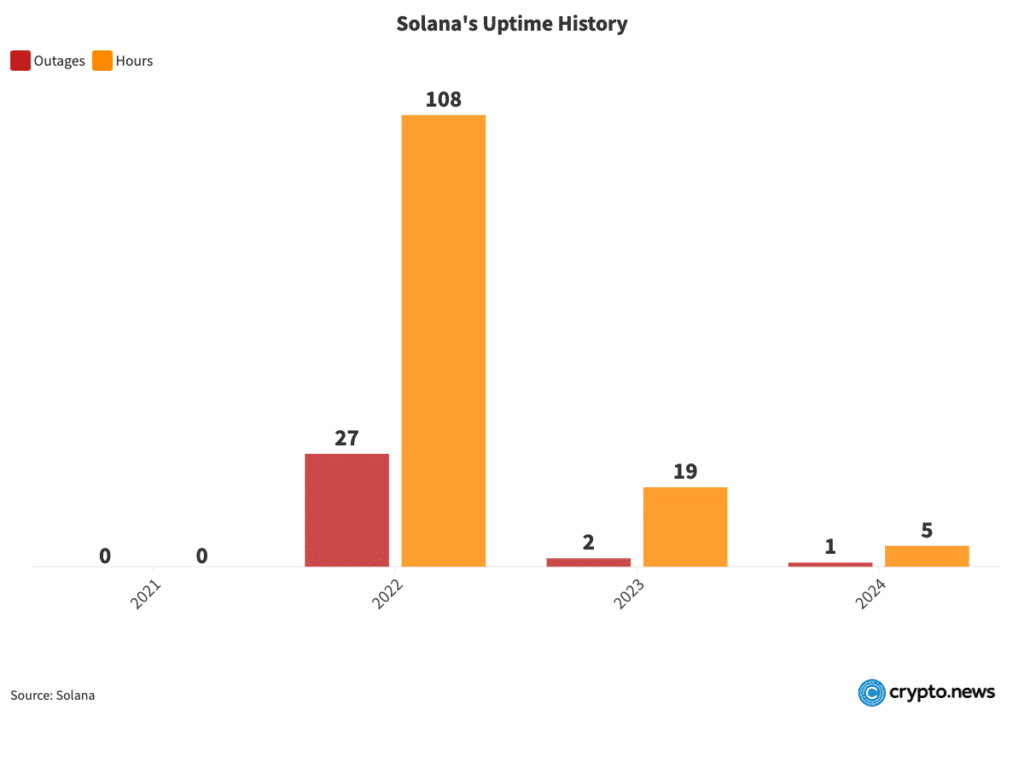

Solana, known for its high-speed transactions and low fees, has faced scrutiny regarding the stability of its network due to numerous outages it has suffered in recent years. However, a closer look reveals that the situation may be exaggerated. The stability of the network becomes evident despite the occasional hiccup when examining Solana’s uptime history.

In 2021, Solana experienced no outages and demonstrated a full year of uninterrupted service. However, 2022 saw a significant increase, with 27 outages totaling 108 hours. Moving forward, 2023 showed notable improvement, with only two outages totaling 19 hours. In 2024, until June 19, the network had only one outage lasting five hours. These numbers, while notable, only tell part of the story.

Solana Uptime Timeline, 2021-2024

When considering uptime, these outages represent a small fraction of total operating hours. For example, in 2022, despite 27 outages, the network maintained functionality 99.47% of the year. Likewise, the 19 hours of downtime in 2023 and 5 hours in 2024 through mid-June represent negligible interruptions in an otherwise stable performance.

The main culprit for these interruptions is Solana’s design. The network emphasizes speed and low costs, which attract heavy usage. This high traffic can lead to congestion and instability. For example, Solana produces a block every 400 ms, much faster than other blockchains. Due to the rapid production speed, when block creation stops for an hour or two, the problem appears more serious. However, other blockchains, including Bitcoin, also face downtime. For example, it took more than two hours to extract the block 689301 next block 689300.

Solana’s strategy of pushing its performance limits allows it to address and solve real-world challenges that theoretical models and simulations cannot predict. This approach is reminiscent of SpaceX’s iterative process of learning from failures to achieve rapid innovation. While some critics view Solana’s historic downtime as a liability, this rigorous testing and troubleshooting phase ultimately provides a significant competitive advantage.

Solana in numbers

Daily active portfolios

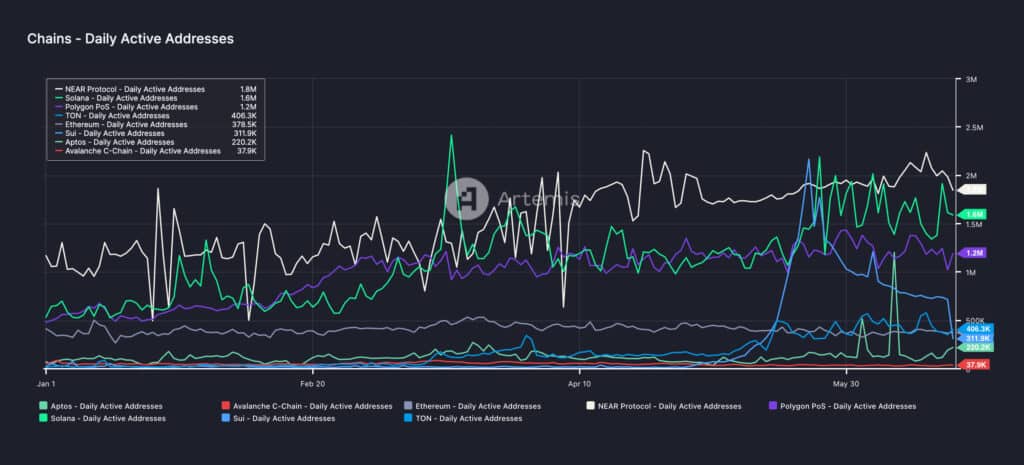

Solana currently has 1,600,000 daily active wallets, significantly higher than Ethereum’s 367,000 daily active wallets.

Daily active addresses, January 2024 – June 2024

Inflows and outflows

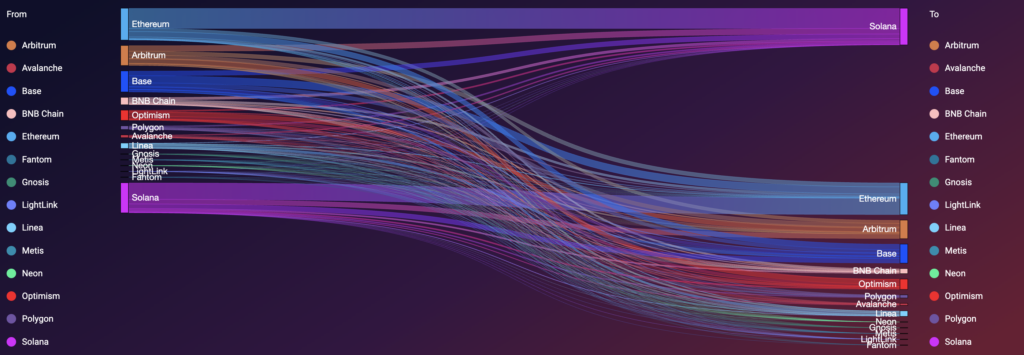

Furthermore, between April 2023 and June 2024, Solana recorded inflows of $801.73 million and outflows of $654.21 million. In contrast, Ethereum recorded inflows of $694.17 million and outflows of $694.1 million. This translates to a net inflow of around $150 million for Solana, compared to Ethereum’s net inflow of around $70,000.

Total amount transferred between bridges, April 2023 – June 2024

Total amount transferred between bridges, April 2023 – June 2024

DEX volumes

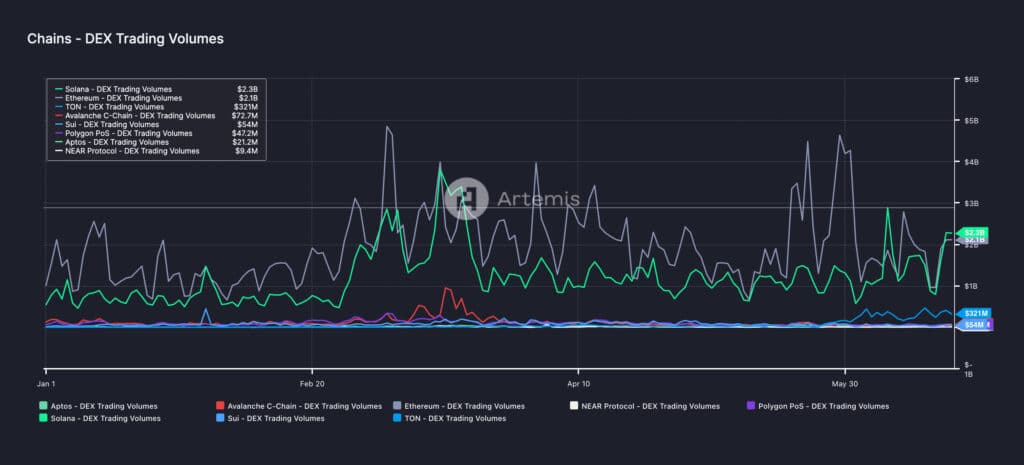

In terms of DEX volumes, Solana also performed excellently. She began to match or exceed Ethereum’s trading volumes on several occasions. This is significant because Solana’s market capitalization is around $63 billion, much lower than Ethereum’s $430 billion. Furthermore, the Solana token was launched just four years ago, compared to Ethereum’s nine years on the market. Despite being newer and smaller, Solana’s ability to compete with Ethereum in DEX volumes shows its potential.

DEX trading volumes, January 2024 – June 2024

Stablecoin transfer volumes

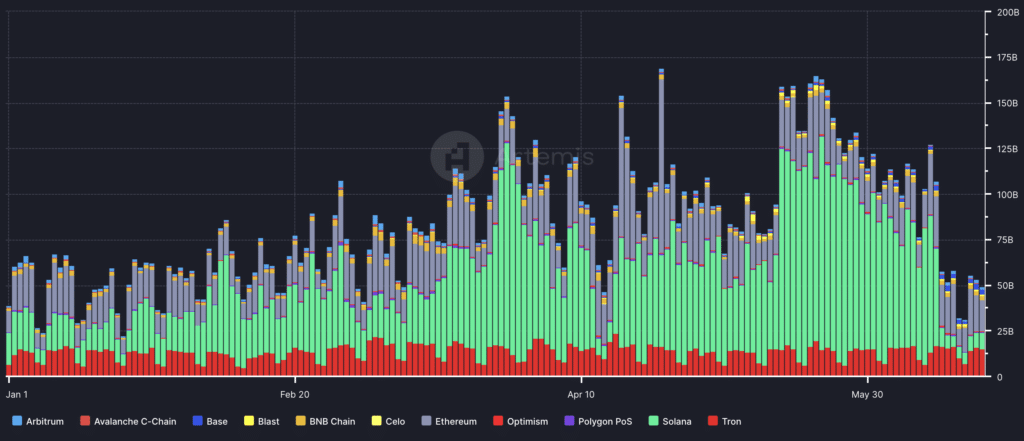

Solana’s high volumes of stablecoin transfers stem from its high transaction speeds and low fees, which make it attractive to users. The network’s ability to process many transactions efficiently supports high-volume activities. Furthermore, Solana’s focus on scalability and user-friendly experience further pushes its dominance in stablecoin transfers.

Stablecoin transfer volumes, January 2024 – June 2024

Income

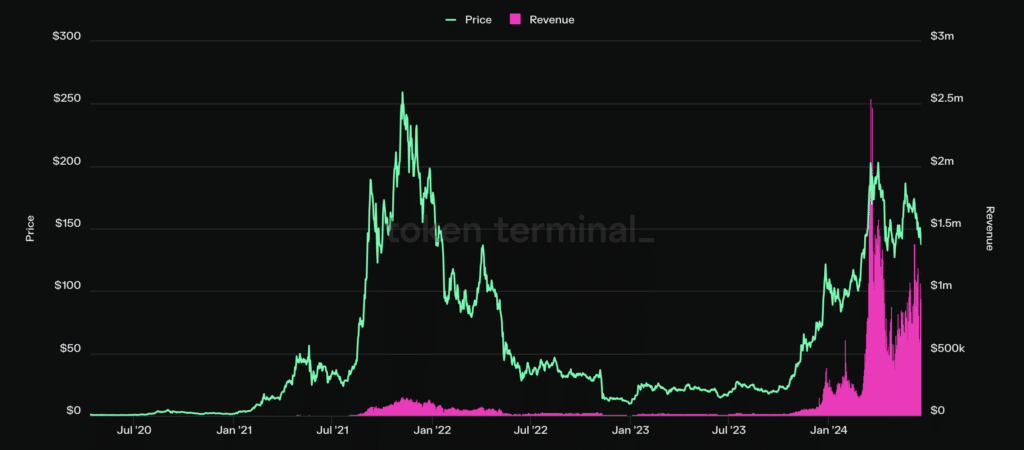

Solana’s revenue increased to 50% of Ethereum’s by mid-2024, an unprecedented level. Historically, during peak periods of activity in 2021 and 2022, Solana’s revenue was less than 1% of Ethereum’s. At the beginning of 2024 this figure stood at around 10%. This dramatic increase in revenue ratio indicates Solana’s growing usage and economic activity on the network.

Solana revenue, April 2020 – June 2024

Conclusion

The narrative of Solana as a centralized and unreliable network does not hold up against the real data. With its strong technical capabilities and growing adoption, Solana demonstrates significant progress and resilience. The Nakamoto coefficient shows that Solana’s decentralization is more favorable than that of Ethereum, with fewer entities required to collude to disrupt the network. While not as decentralized as Bitcoin, Solana still maintains a substantial level of decentralization, which contributes to its security and reliability.

Network stability, often criticized due to past outages, shows marked improvement, with substantial uptime and continuous improvements. Solana’s strategic focus on high performance and scalability results in occasional instability but also rapid innovation and resilience similar to the iterative development seen in other cutting-edge technology fields.

Metrics such as daily active wallets, inflows and outflows, decentralized trading volumes, and revenue indicate Solana’s growing importance in the cryptocurrency ecosystem. Despite its small market capitalization and young age, the network’s ability to handle high transaction volumes at low costs positions it as a formidable competitor to Ethereum.

Overall, Solana’s performance and growth reflects a platform that is not only maturing but also setting new standards in the industry, challenging prevailing negative perceptions and establishing itself as a valuable asset in the market.

Disclosure: This article does not constitute investment advice. The contents and materials on this page are for educational purposes only.

News

Cryptocurrency Price August 1: Bitcoin Dips Below $65K; Solana, XRP Down Up To 8%

Major cryptocurrencies fell in Thursday trading following the Federal Reserve’s decision to keep its key interest rate unchanged. Overnight, the U.S. Federal Reserve kept its key interest rate at 5.25-5.5% for the eighth consecutive time, as expected, while also signaling the possibility of a rate cut at its next meeting in September. The unanimous decision by the Federal Open Market Committee reflects a continued wait-and-see approach as it monitors inflation trends.

CoinSwitch Markets Desk said: “Bitcoin has fallen below $65,000 after the US Federal Reserve announced it would keep interest rates unchanged. However, with markets now anticipating rate cuts at the next Federal Reserve meeting in September, the outlook for a Bitcoin rally by the end of the year has strengthened.”

Meanwhile, CoinDCX research team said: “The crypto market has plunged after the Fed decision. Tomorrow’s US unemployment rate announcement is expected to induce more volatility, with the ‘actual’ figure coming in higher than the ‘expected’ one, which is positive for cryptocurrencies.”

At 12:21 pm IST, Bitcoin (BTC) was down 3.2% at $64,285, while Ethereum was down nearly 4.5% at $3,313. Meanwhile, the global market cryptocurrency The market capitalization fell 3.6% to around $2.3 trillion in the last 24 hours.

“Bitcoin needs to clear its 200-day EMA at $64,510 to consolidate further. Otherwise, a retest of $62,000 could be in the cards,” said Vikram Subburaj, CEO of Giottus.

Altcoins and meme coins, such as BNB (3%), Solana (8%), XRP (5.7%), Dogecoin (5%), Cardano (4.6%), Avalanche (4.3%), Shiba Inu (3.8%), Polkadot (3.4%), and Chainlink (4%) also saw declines.

The volume of all stablecoins is now $71.64 billion, which is 92.19% of the total cryptocurrency market volume in 24 hours, according to data available on CoinMarketCap. Bitcoin’s dominance is currently 54.99%. BTC volume in the last 24 hours increased by 23.3% to $35.7 billion.

(Disclaimer: Recommendations, suggestions, opinions and views provided by experts are personal. They do not represent the views of the Economic Times)

(You can now subscribe to our ETMarkets WhatsApp Channel)

News

Altcoins WIF, BONK, RUNE, JUP Down 10% While Bitcoin Drops 4%

Altcoins dogwifhat, Bonk, THORChain, and Jupiter have suffered losses of more than 10%, while Bitcoin is down 4% in the last 24 hours.

After a period of relative calm yesterday, July 31, Bitcoin (BTC) price action has seen a drastic change as the cryptocurrency dropped by more than $3,500, bringing its value to $63,300. At the same time, altcoins mirrored this trend, with the total value of liquidated positions rising to nearly $225 million over the course of the day.

Initially, the week started on a positive note for Bitcoin, which reached its highest point since early June, hitting $70,000. However, this peak was short-lived, as it was quickly rejected, leading to a substantial decline, with Bitcoin falling below $65,500.

The cryptocurrency managed to regain some stability, trading comfortably at around $66,800. However, following a Press conference According to Federal Reserve Chairman Jerome Powell, the value of Bitcoin has fallen again to $64,300, down more than 3% in 24 hours.

BTC Price Chart 24 Hours | Source: crypto.news

The recession coincided with a relationship from the New York Times stating that Iran had called for retaliatory measures against Israel following the assassination of Hamas leader Ismail Haniyeh in Tehran, increasing the risk of further conflict in the region.

Meanwhile, on the economic front, the Federal Reserve decided to keep its benchmark interest rates in place, offering little information on a planned September rate cut. Powell also hinted that while no concrete decisions have been made on the September adjustment, there is growing consensus that a rate cut is likely.

Amid Bitcoin’s decline, altcoins have suffered even more significant losses. For example, dogwifhat (Wife) saw a 12.4% drop and (DISGUST) has suffered a 10% drop. Other altcoins such as THORChain (RUNE) also fell by 10%, while Jupiter (JUPITER) and the Ethereum naming service (ENS) decreased by 8% and 9% respectively.

Among the largest-cap cryptocurrencies, the biggest losers are Solana (SOL) with a decrease of 8%, (Exchange rate risk) down 6%, Cardano (ADA) down 4%, and both Ethereum (ETH) and Dogecoin (DOGE) recording a decrease of 4.4%.

Data from CoinGlass indicates that approximately 67,000 traders have been negatively impacted by this increased volatility. BTC positions have seen $61.85 million in liquidations, while ETH positions have faced $61 million. In total, the value of liquidated positions stands at $225.4 million at the time of writing.

News

Riot Platforms Sees 52% Drop in Bitcoin Production in Q2

Bitcoin mining firm Riot Platforms has released its second-quarter financial results, highlighting a decline in cryptocurrency mined due to the recent halving.

Colorado-based Bitcoin (BTC) mining company Riot platforms revealed its second quarter financial results, highlighting a significant reduction in mined cryptocurrencies attributed to the recent halving event that took place in early April.

The company reported total revenue of $70 million for the quarter ended July 31, a decline of 8.7% compared to the same period in 2023. Riot Platforms attributed the revenue decline primarily to a $9.7 million decrease in engineering revenue, which was partially mitigated by a $6 million increase in Bitcoin extraction income.

During the quarter, the company mined 844 BTC, representing a decline of over 50% from Q2 2023, citing the halving event and increasing network difficulty as major factors behind the decline. Riot Platforms reported a net loss of $84.4 million, or $0.32 per share, missing Zacks Research forecast a loss of $0.16 per share.

Halving increases competitive pressure

The Colorado-based firm said the average cost of mining one BTC in the second quarter, including energy credits, rose to $25,327, a remarkable 341% increase from $5,734 per BTC in the same quarter of 2023. Despite this significant increase in production costs, the firm remains optimistic about maintaining competitiveness through recent deals.

For example, following the Recent acquisition Cryptocurrency firm Block Mining, Riot has increased its distributed hash rate forecast from 31 EH/s to 36 EH/s by the end of 2024, while also increasing its 2025 forecast from 40 EH/s to 56 EH/s.

Riot Platforms Hashrate Growth Projections by 2027 | Source: Riot Platforms

Commenting on the company’s financials, Riot CEO Jason Les said that despite the halving, the mining company still managed to achieve “significant operational growth and execution of our long-term strategy.”

“Despite this reduction in production available to all Bitcoin miners, Riot reported $70 million in revenue for the quarter and maintained strong gross margins in our core Bitcoin mining business.”

Jason Les

Following its Q2 financial report, Riot Platforms shares fell 1.74% to $10.19, according to Google Finance data. Meanwhile, the American miner continues to chase Canadian rival Bitfarms, recently acquiring an additional 10.2 million BITF shares, increasing its stake in Bitfarms to 15.9%.

As previously reported by crypto.news, Riot was the first announced a $950 million takeover bid for Bitfarms in late May, arguing that Bitfarms’ founders were not acting in the best interests of all shareholders. They said their proposal was rejected by Bitfarms’ board without substantive engagement.

In response, Bitfarms She said that Riot’s offer “significantly understates” its growth prospects. Bitfarms subsequently implemented a shareholder rights plan, also known as a “poison pill,” to protect its strategic review process from hostile takeover attempts.

News

Aave Price Increases Following Whales Accumulation and V3.1 Launch

Decentralized finance protocol Aave is seeing a significant spike in whale activity as the market looks to recover from the recent crash that pushed most altcoins into key support areas earlier this week.

July 31, Lookonchain shared details indicating that the whales had aggressively accumulated Aave (AAVE) over the past two days. According to the data, whales have withdrawn over 58,848 AAVE worth $6.47 million from exchanges during this period.

In one instance, whale address 0x9af4 withdrew 11,185 AAVE worth $1.23 million from Binance. Meanwhile, another address moved 21,619 AAVE worth over $2.38 million from the exchange and deposited the tokens into Aave.

These withdrawals follow a previous transfer of 26,044 AAVE from whale address 0xd7c5, amounting to over $2.83 million withdrawn from Binance.

AAVE price has surged over 7% in the past 24 hours amid buy-side pressure from these whales. The DeFi token is currently trading around $111 after jumping over 18% in the past week.

Recently, the price of AAVE increased by over 8% after Aave founder Marc Zeller announced a proposed fee change aimed at adopting a buyback program for AAVE tokens.

Aave v3.1 is available

The total value locked in the Aave protocol currently stands at around $22 billion. According to DeFiLlamaApproximately $19.9 billion is on Aave V3, while the V2 chain still holds approximately $1.9 billion in TVL and V1 approximately $14.6 million.

Aave Labs announced Previously, Aave V3.1 was made available on all networks with active Aave V3 instances.

V3.1 features improvements that are intended to improve the overall security of the DeFi protocol. The Aave DAO governance has approved the v3.1 improvements, which also include operational efficiency and usability for the network.

Meanwhile, Aave Labs recently outlined a ambitious roadmap for the projectwith a 2030 vision for Aave V4, among other developments.

-

Regulation12 months ago

Regulation12 months agoRipple CTO and Cardano founder clash over XRP’s regulatory challenges ⋆ ZyCrypto

-

Regulation10 months ago

Regulation10 months agoNancy Pelosi Considers Supporting Republican Crypto Bill FIT21 – London Business News

-

Videos11 months ago

Videos11 months agoCryptocurrency News: Bitcoin, ETH ETF, AI Crypto Rally, AKT, TON & MORE!!

-

Regulation11 months ago

Regulation11 months agoBitcoin’s future is ‘bleak’ and ripe for regulation, says lead developer

-

News9 months ago

News9 months agoAave Price Increases Following Whales Accumulation and V3.1 Launch

-

Regulation9 months ago

Regulation9 months agoSouth Korea Imposes New ‘Monitoring’ Fees on Cryptocurrency Exchanges

-

Regulation9 months ago

Regulation9 months agoA Blank Sheet for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation9 months ago

Regulation9 months agoCryptocurrency Regulations in Slovenia 2024

-

News11 months ago

News11 months agoThe trader earned $46 million with PEPE after reaching a new ATH

-

Regulation11 months ago

Regulation11 months agoCrypto needs regulation to thrive: Tyler Cowen

-

Blockchain11 months ago

Blockchain11 months agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Blockchain11 months ago

Blockchain11 months agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto