News

What the data really shows

Few platforms have faced as much skepticism as Solana. Critics often describe it as a centralized network plagued by frequent outages. However, that narrative does not align with the actual data and progress witnessed within the Solana ecosystem. This article seeks to dispel these misconceptions by comprehensively analyzing Solana’s key parameters.

Contrary to the prevailing negative perception, Solana shows remarkable growth and innovation on multiple fronts. The growing volumes of stablecoins traded on its network and larger decentralized exchange (DEX) volumes compared to Ethereum highlight Solana’s expanding utility. Additionally, the platform’s superior data rate showcases its technical capabilities and resilience. Additionally, the surge in new addresses and daily active users further reflects the growing trust and adoption among the broader crypto community.

By examining these metrics, this article aims to provide a balanced, data-driven perspective on why Solana is an undervalued asset in the cryptocurrency market as of June 2024.

Centralization

The decentralization of a blockchain network is complex and cannot be evaluated simply on one metric. An in-depth look at how the network is truly decentralized based on every detail could fill an entire article. Therefore, we will focus on the Nakamoto coefficient. The Nakamoto coefficient measures the minimum number of entities in a network needed to collude to disrupt the system. For proof-of-stake networks like Solana and Ethereum, a 33% share is significant, while for proof-of-work networks like Bitcoin, 51% control is crucial.

As of June 20, 2024, Solana has 1,525 active validators, including 20 holding more than 33% stake. On the other hand, Ethereum has 1,024,619 active validators, with only two entities controlling more than 33% of the stake. A validator must stake 32 ETH to become a node on the Ethereum network. The problem here is that one entity can control multiple validators, masking the actual level of decentralization.

Active validators and Nakamoto coefficient, June 20, 2024

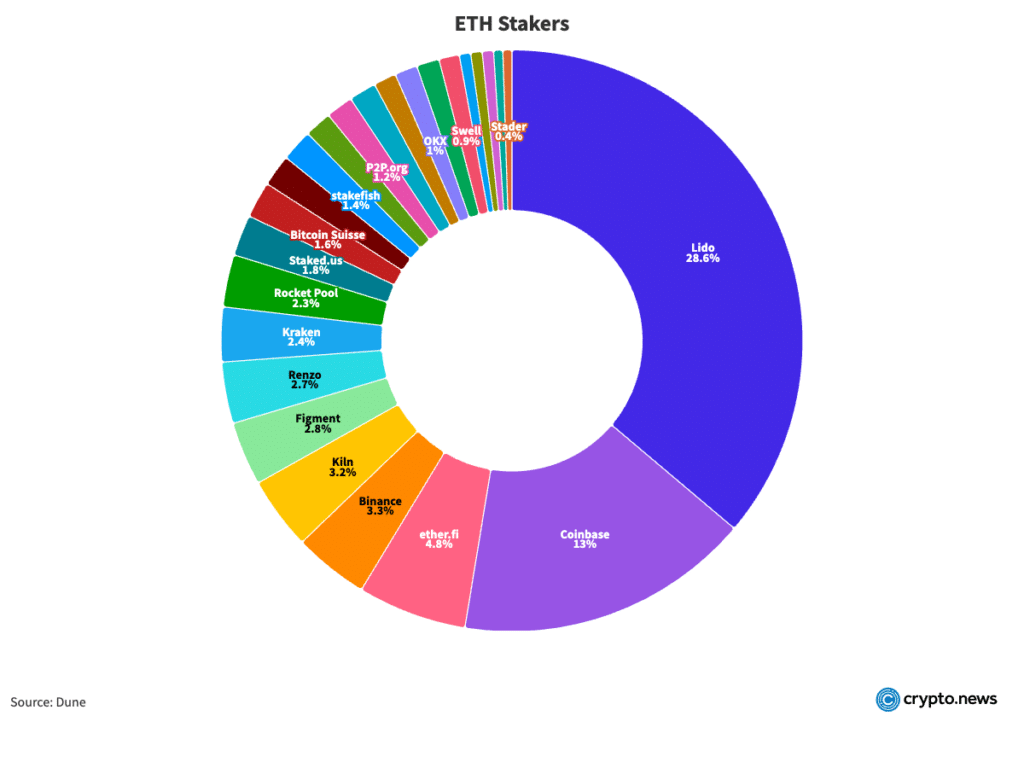

Second Dune, Lido and Coinbase hold over 33% stake in Ethereum. If each node contains 32 ETH, then of the 1,024,629 active nodes, these two entities potentially control 432,389 unique validators. This concentration of control under two entities undermines the ethics of decentralization.

ETH Stakers Pie Chart, June 20, 2024

For Bitcoin, the network has 17,692 full nodes that have not been pruned, of which 7,516 are capable of disrupting the network. Unfortunately, there is no information about the individual hashrate of each node. The Peer Index (PIX) was used to calculate this number. The PIX value, ranging from 0.0 to 10.0, updates every 24 hours based on node properties and network parameters, with 10.0 being the most desirable. Nodes with a PIX value equal to or greater than 5 were considered.

Some may argue that Bitcoin’s decentralization should be assessed through hashrate distribution. Currently, two mining poolsFoundry USA and Antpool, control over 51% of the network’s hashrate.

Bitcoin Mining Pools Pie Chart, June 20, 2024

However, it is incorrect to consider these pools as the controllers of the network because they are pools of individual miners. Mining pools allow miners to combine their computational resources to increase their chances of solving blocks and earning rewards. If a pool begins to act maliciously, individual miners can simply switch to a different pool, maintaining the decentralization of the network.

Although the decentralization of blockchain networks is multifaceted and cannot be accurately assessed by a single metric, the Nakamoto coefficient provides a useful lens for comparison. Solana’s position is not as worrying as it might initially seem. With a Nakamoto coefficient indicating that 20 validators hold more than 33% of the share, Solana appears more decentralized than Ethereum, where only two entities hold more than 33% of the share. Furthermore, even though Solana is not as decentralized as Bitcoin, it still maintains a solid level of decentralization, contributing to its security and reliability.

Stability

Solana, known for its high-speed transactions and low fees, has faced scrutiny regarding the stability of its network due to numerous outages it has suffered in recent years. However, a closer look reveals that the situation may be exaggerated. The stability of the network becomes evident despite the occasional hiccup when examining Solana’s uptime history.

In 2021, Solana experienced no outages and demonstrated a full year of uninterrupted service. However, 2022 saw a significant increase, with 27 outages totaling 108 hours. Moving forward, 2023 showed notable improvement, with only two outages totaling 19 hours. In 2024, until June 19, the network had only one outage lasting five hours. These numbers, while notable, only tell part of the story.

Solana Uptime Timeline, 2021-2024

When considering uptime, these outages represent a small fraction of total operating hours. For example, in 2022, despite 27 outages, the network maintained functionality 99.47% of the year. Likewise, the 19 hours of downtime in 2023 and 5 hours in 2024 through mid-June represent negligible interruptions in an otherwise stable performance.

The main culprit for these interruptions is Solana’s design. The network emphasizes speed and low costs, which attract heavy usage. This high traffic can lead to congestion and instability. For example, Solana produces a block every 400 ms, much faster than other blockchains. Due to the rapid production speed, when block creation stops for an hour or two, the problem appears more serious. However, other blockchains, including Bitcoin, also face downtime. For example, it took more than two hours to extract the block 689301 next block 689300.

Solana’s strategy of pushing its performance limits allows it to address and solve real-world challenges that theoretical models and simulations cannot predict. This approach is reminiscent of SpaceX’s iterative process of learning from failures to achieve rapid innovation. While some critics view Solana’s historic downtime as a liability, this rigorous testing and troubleshooting phase ultimately provides a significant competitive advantage.

Solana in numbers

Daily active portfolios

Solana currently has 1,600,000 daily active wallets, significantly higher than Ethereum’s 367,000 daily active wallets.

Daily active addresses, January 2024 – June 2024

Inflows and outflows

Furthermore, between April 2023 and June 2024, Solana recorded inflows of $801.73 million and outflows of $654.21 million. In contrast, Ethereum recorded inflows of $694.17 million and outflows of $694.1 million. This translates to a net inflow of around $150 million for Solana, compared to Ethereum’s net inflow of around $70,000.

DEX volumes

In terms of DEX volumes, Solana also performed excellently. She began to match or exceed Ethereum’s trading volumes on several occasions. This is significant because Solana’s market capitalization is around $63 billion, much lower than Ethereum’s $430 billion. Furthermore, the Solana token was launched just four years ago, compared to Ethereum’s nine years on the market. Despite being newer and smaller, Solana’s ability to compete with Ethereum in DEX volumes shows its potential.

DEX trading volumes, January 2024 – June 2024

Stablecoin transfer volumes

Solana’s high volumes of stablecoin transfers stem from its high transaction speeds and low fees, which make it attractive to users. The network’s ability to process many transactions efficiently supports high-volume activities. Furthermore, Solana’s focus on scalability and user-friendly experience further pushes its dominance in stablecoin transfers.

Stablecoin transfer volumes, January 2024 – June 2024

Income

Solana’s revenue increased to 50% of Ethereum’s by mid-2024, an unprecedented level. Historically, during peak periods of activity in 2021 and 2022, Solana’s revenue was less than 1% of Ethereum’s. At the beginning of 2024 this figure stood at around 10%. This dramatic increase in revenue ratio indicates Solana’s growing usage and economic activity on the network.

Solana revenue, April 2020 – June 2024

Conclusion

The narrative of Solana as a centralized and unreliable network does not hold up against the real data. With its strong technical capabilities and growing adoption, Solana demonstrates significant progress and resilience. The Nakamoto coefficient shows that Solana’s decentralization is more favorable than that of Ethereum, with fewer entities required to collude to disrupt the network. While not as decentralized as Bitcoin, Solana still maintains a substantial level of decentralization, which contributes to its security and reliability.

Network stability, often criticized due to past outages, shows marked improvement, with substantial uptime and continuous improvements. Solana’s strategic focus on high performance and scalability results in occasional instability but also rapid innovation and resilience similar to the iterative development seen in other cutting-edge technology fields.

Metrics such as daily active wallets, inflows and outflows, decentralized trading volumes, and revenue indicate Solana’s growing importance in the cryptocurrency ecosystem. Despite its small market capitalization and young age, the network’s ability to handle high transaction volumes at low costs positions it as a formidable competitor to Ethereum.

Overall, Solana’s performance and growth reflects a platform that is not only maturing but also setting new standards in the industry, challenging prevailing negative perceptions and establishing itself as a valuable asset in the market.

Disclosure: This article does not constitute investment advice. The contents and materials on this page are for educational purposes only.