Regulation

Where Biden’s Top Six Potential Replacements Stand on Crypto

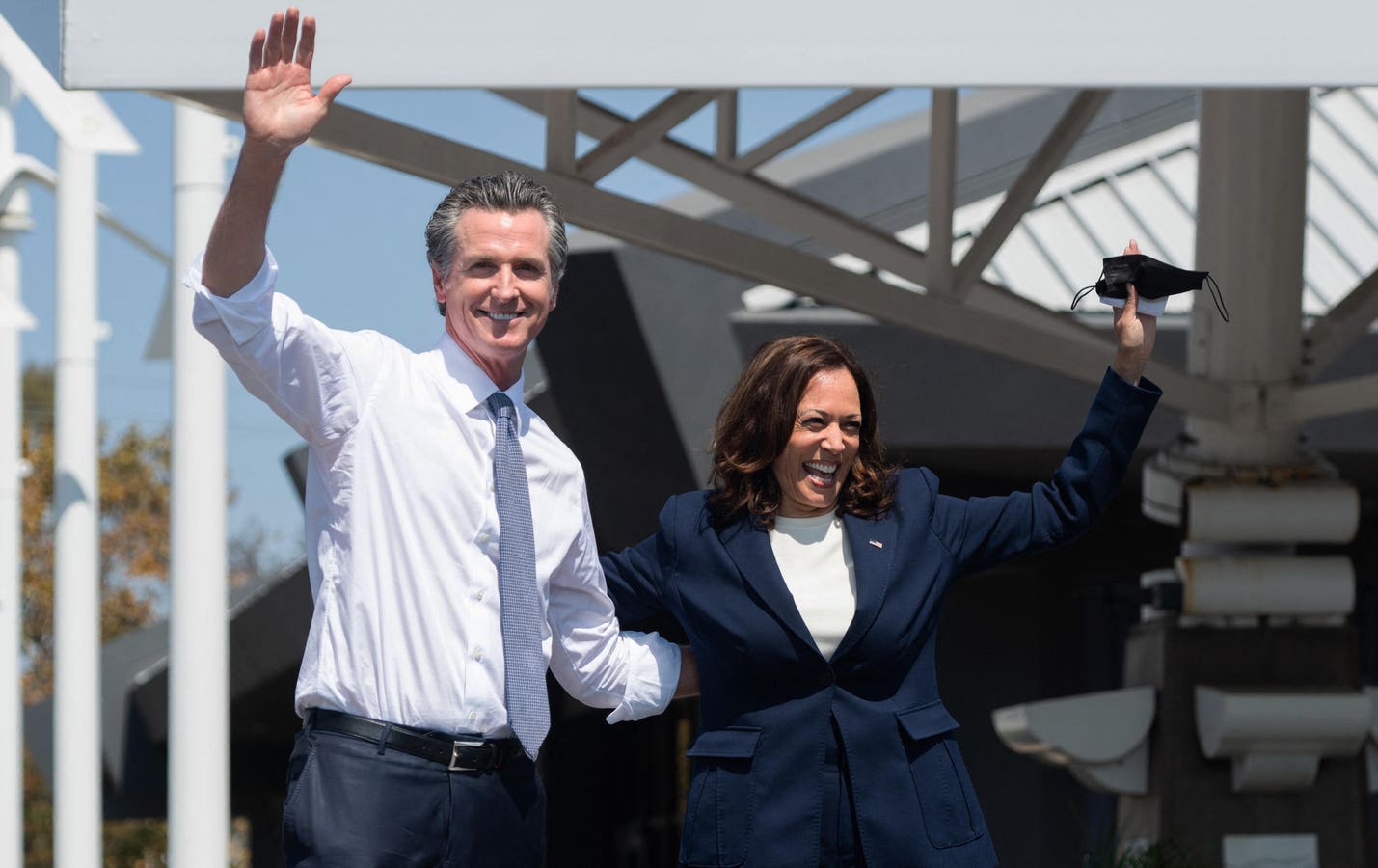

US Vice President Kamala Harris and California Governor Gavin Newsom are two potential replacements… [+] for President Joe Biden if he decides to withdraw from the election. (Photo by SAUL LOEB / AFP) (Photo by SAUL LOEB/AFP via Getty Images)

AFP via Getty Images

President Biden’s disappointing performance in Thursday night’s debate has Democrats looking to replace him ahead of next month’s nominating convention in Chicago. While the president appears determined to remain at the top of the ticket, at least for now, the focus is now on how his successors might fare in the general election and their policies on critical issues.

A few thousand votes could be decisive, and suddenly crypto becomes a winning election issue for Republicans, including former President Donald Trump. Although Trump has said he is “not a fan“After serving as president of the United States from 2016 to 2020, he reversed course in late May, promising to make the United States a global leader in cryptocurrencies by ending regulatory hostility. Republicans in Congress are also leading efforts to craft crypto-friendly legislation that would pave the way for the $2.4 trillion industry to be broadly assimilated into the U.S. economy.

The policy shift stands in stark contrast to the Biden administration, which has drawn widespread anger from the community. This is largely due to the Security and Exchange Commission (SEC), under Gary Gensler,’s propensity to pursue exchanges and token issuers for alleged violations of 90-year-old federal securities laws, rather than caving to industry demands by creating new cryptocurrency regulations.

“Imagine if there were 20,000 people in Wisconsin who were voting on one issue and were like, ‘You know what? I’m either not going to vote for Joe Biden or I’m going to vote for Trump because he’s pro-crypto,’” says Anthony Scaramucci, a former Trump White House communications director who is now supporting Biden’s reelection campaign.

Additionally, the crypto industry is flexing its muscles more than ever. After bitcoin hit a record price of $74,000 in March, crypto-focused political action committees raised more than $100 million, the third-most of any cause this election cycle, from Coinbase, Coinbase CEO Brian Armstrong, Ripple, Andreessen Horowitz, and Cameron and Tyler Winklevoss, according to a report by Public citizen. They’ve already defeated anti-crypto candidates in key primaries in New York and California. Those ready-to-spend funds could become even more critical for a Biden replacement who would need to quickly build a campaign war fund.

Neither candidate has responded to Forbes’ inquiries about their cryptocurrency policies since Thursday night’s debate, but here’s a look at their past positions and legislative history with the industry.

Vice President Kamala Harris

Vice President Kamala Harris (Photo by Ethan Miller/Getty Images)

Getty Images

Vice President Kamala Harris has been tight-lipped about her stance on cryptocurrency regulation, despite hailing from the tech-dominated San Francisco Bay Area. However, should she assume the candidacy (or the presidency, for that matter), it’s reasonable to expect her policies to mimic those of the current president.

The Biden administration has pledged to take a “whole government” approach to regulating crypto, signing an executive order in September 2022 outlining six priorities: consumer and investor protection, financial stability, financial crime, global competitiveness, financial inclusion, and innovation, though most activity so far has focused on SEC enforcement actions. President Biden also recently vetoed a congressional repeal of SEC Staff Accounting Bulletin 121, which essentially banned banks from custody of digital assets like bitcoin and ether on behalf of their customers, much to the dismay of the industry.

California Governor Gavin Newsom

California Governor Gavin Newsom (Photo by Justin Sullivan/Getty Images)

Getty Images

Newsom has taken a cautious stance on cryptocurrency regulation as the elected leader of a state known for both progressive policies and technological innovation.

In May 2022, at the start of the bear market, Newsom signed a Executive Decree to create a framework for licensing cryptocurrency companies in the state. However, he vetoed such a bill in September, just weeks before the FTX crash, saying it was “premature to lock in a licensing structure” and that “a more flexible approach is needed.” The governor was critical by consumer advocates for not acting in time, in response to which he told the Los Angeles Times he didn’t regret his decisions.

Newsom ultimately signed Assembly Bill 39, the Digital Financial Assets Act, in October 2023, which directs the Department of Financial Protection and Innovation (DFPI) to create a licensing and enforcement framework for the state by July 1, 2025. At the time of signing, Newsom warned of the law’s “ambiguity” and called for further refinement, while the DFPI is currently gathering public comment.

California’s law has the potential to compete with New York’s BitLicense regulatory regime, a controversial piece of legislation that is nonetheless the strongest regulatory structure in the country. Bloomberg LawAbout one in four North American cryptocurrency companies are headquartered in California.

Colorado Governor Jared Polis

Colorado Governor Jared Polis (Photo by Jason Connolly/AFP) (Photo by JASON CONNOLLY/AFP via Getty … [+] Images)

AFP via Getty Images

Polis is the most pro-cryptocurrency potential Democratic presidential candidate. The libertarian-leaning Democrat touts cryptocurrency as an example of technological and financial freedom, describing it as an antidote to “big government” at the State Capitol on February 27, 2022, “Blockchain Day.”

Like Trump, Polis has accepted campaign contributions in cryptocurrencies, accepting major tokens like bitcoin and ether and even “memecoins” like dogecoin and shiba inu coin. The state of Colorado also began accepting tax payments in cryptocurrency under his leadership in 2022, though those payments must be done via the Paypal Cryptocurrencies Hub, which converts them into fiat currency before the transaction.

However, most of Polis’ advocacy for the industry ended after 2022. Polis spoke at ETH Denver in February of that year, saying he wanted Colorado to become “the first digital state.“He also spoke at the convention of 2020 And 2021In 2022, he also speculated about the possibility of putting the state’s livestock branding registry on the blockchain to make government processes more efficient, transparent, and decentralized. He said the state’s cooperative business laws made it an ideal place to create a decentralized autonomous organization, or DAO. Polis said at the time that he personally does not own any cryptocurrency.

In 2016, while Polis was a member of the House of Representatives, he was a founding member of the Congressional Blockchain Caucus.

Polis hasn’t spoken about cryptocurrency since the FTX collapse.

Illinois Governor JB Pritzker

Illinois Governor JB Pritzker (Photo by Paul Natkin/Getty Images)

Getty Images

Pritzker has remained relatively quiet on the subject of cryptocurrencies, engaging primarily with the industry as an opportunity to promote economic development in Chicago. In 2021, for example, Pritzker visited the Grant Park-adjacent offices of cryptocurrency trading platform Coinflip to celebrate the announcement of its new headquarters. Pritzker has said that “the future of cryptocurrencies is in Illinois.” Like Polis, much of Pritzker’s tech enthusiasm has shifted to supporting the quantum computing industry since 2022.

The Illinois State Financial Protection Agency announced a series of cryptocurrency consumer protection laws in February, but Pritzker has not publicly claimed credit for them. The two-bill package seeks to update financial regulations surrounding the transmission of digital currency, which a press release compares to New York’s BitLicense and California’s proposed licensing structure, and to strengthen enforcement to protect ordinary citizens. Democratic state Rep. Mark Walker and state Sen. Laura Ellman sponsored the bills.

Pennsylvania Governor Josh Shapiro

Pennsylvania Governor Josh Shapiro (Photo by Mark Makela/Getty Images)

Getty Images

Shapiro has not publicly shared his views on federal regulation of cryptocurrencies. However, state tax breaks created to encourage the creation of data centers in the state have been used by cryptocurrency mining companies, driving up costs to taxpayers by $5 to $90 million by 2027. Environmental group Save Carbon County continued Polis and a cryptocurrency mining company in March for allegedly polluting the environment while receiving $29 million in state tax credits over the past two years.

Pennsylvania Department of Banking and Securities moved to include The department added that the term “cryptocurrency” was used in its definition of “currency” when it oversaw the state’s money transmission law, meaning it has the authority to regulate certain aspects of the state’s cryptocurrency industry. This is a reversal from a 2019 policy in which the department said it did not consider cryptocurrency in its goals. No major regulatory action has yet been taken as a result, and Shaprio has not taken responsibility for or commented on the change.

Gretchen Whitmer

Michigan Governor Gretchen Whitmer (Photo by Bill Pugliano/Getty Images)

Getty Images

Michigan Governor Gretchen Whitmer has yet to publicly comment on cryptocurrencies. In December 2019, the last year of Whitmer’s first year in office, four bills were passed to include cryptocurrency and distributed ledgers in the state’s criminal code, allowing the state to prosecute financial crimes. State laws also require a license to transmit money, which includes “funds in an electronic wallet” according to the Ministry of Insurance and Financial Services.

Regulation

Crypto community gets involved in anti-government protests in Nigeria

Amid the #EndBadGovernanceInNigeria protests in Nigeria, a notable shift is occurring within the country’s cryptocurrency sector. As the general public demands sweeping governance reforms, crypto community leaders are seizing the opportunity to advocate for specific regulatory changes.

Rume Ophi, former secretary of the Blockchain Stakeholders Association of Nigeria (SiBAN), stressed the critical need to integrate crypto-focused demands into the broader agenda of the protests.

Ophi explained the dual benefit of such requirements, noting that proper regulation can spur substantial economic growth by attracting investors and creating job opportunities. Ophi noted, “Including calls for favorable crypto regulations is not just about the crypto community; it’s about leveraging these technologies to foster broader economic prosperity.”

Existing government efforts

In opposition to Ophi’s call for action, Chimezie Chuta, chair of the National Blockchain Policy Steering Committee, presents a different view. He pointed out The Nigerian government continued efforts to nurture the blockchain and cryptocurrency industries.

According to Chuta, the creation of a steering committee was essential to effectively address the needs of the crypto community.

Chuta also highlighted the creation of a subcommittee to harmonize regulations for virtual asset service providers (VASPs). With the aim of streamlining operations and providing clear regulatory direction, the initiative involves cooperation with major organizations including the Securities and Exchange Commission (SEC) and the Central Bank of Nigeria (CBN). “Our efforts should mitigate the need for protest as substantial progress is being made to address the needs of the crypto industry,” Chuta said.

A united call for support

The ongoing dialogue between the crypto community and government agencies reflects a complex landscape of negotiations and demands for progress.

While actors like Ophi are calling for more direct action and the inclusion of crypto demands in protest agendas, government figures like Chuta are advocating for recognition of the steps already taken.

As protests continue, the crypto community’s push for regulatory reform highlights a crucial aspect of Nigeria’s broader fight to improve governance and economic policies. Both sides agree that favorable regulations are critical to the successful adoption and implementation of blockchain technologies, signaling a potentially transformative era for Nigeria’s economic framework.

Read also : OKX Exchange Exits Nigerian Market Amid Regulatory Crackdown

Regulation

Cryptocurrency Regulations in Slovenia 2024

Slovenia, a small but highly developed European country with a population of 2.1 million, boasts a rich industrial history that has contributed greatly to its strong economy. As the most economically developed Slavic nation, Slovenia has grown steadily since adopting the euro in 2007. Its openness to innovation has been a key factor in its success in the industrial sector, making it a prime destination for cryptocurrency enthusiasts. Many believe that Slovenia is poised to become a powerful fintech hub in Europe. But does its current regulatory framework for cryptocurrencies support such aspirations?

Let’s explore Slovenia’s cryptocurrency regulations and see if they can propel the country to the forefront of the cryptocurrency landscape. My expectations are positive. What are yours? Before we answer, let’s dig a little deeper.

1. Cryptocurrency regulation in Slovenia: an overview

Slovenia is renowned for its innovation-friendly stance, providing a supportive environment for emerging technologies such as blockchain and cryptocurrencies. Under the Payment Services and Systems Act, cryptocurrencies are classified as virtual assets rather than financial or monetary instruments.

The regulation of the cryptocurrency sector in Slovenia is decentralized. Different authorities manage different aspects of the ecosystem. For example, the Bank of Slovenia and the Securities Market Agency oversee cryptocurrency transactions to ensure compliance with financial laws, including anti-money laundering (AML) and terrorist financing regulations. The Slovenian Act on the Prevention of Money Laundering and Terrorist Financing (ZPPDFT-2) incorporates the EU’s 5th Anti-Money Laundering Directive (5MLD) and aligns with the latest FATF recommendations. All virtual currency service providers must register with the Office of the Republic of Slovenia.

2. Cryptocurrency regulation in Slovenia: what’s new?

Several notable developments have taken place this year in the cryptocurrency sector in Slovenia:

July 25, 2024:Slovenia has issued a €30 million on-chain digital sovereign bond, the first of its kind in the EU, with a yield of 3.65%, maturing on 25 November 2024.

May 14, 2024:NiceHash has announced the first Slovenian Bitcoin-focused conference, NiceHashX, scheduled for November 8-9 in Maribor.

3. Explanation of the tax framework for cryptocurrencies in Slovenia

The Slovenian cryptocurrency tax framework provides clear guidelines for individuals and businesses. According to the Slovenian Financial Administration, the tax treatment depends on the status of the trader and the nature of the transaction.

- People:Income earned from cryptocurrencies through employment or ongoing business activities is subject to personal income tax. However, capital gains from transactions or market fluctuations are exempt from tax.

- Companies:Capital gains from cryptocurrency-related activities are subject to a 19% corporate tax. Value-added tax (VAT) generally applies at a rate of 22%, although cryptocurrency transactions that are considered as means of payment are exempt from VAT. Companies are not allowed to limit payment methods to cryptocurrencies alone. Tokens issued during ICOs must follow standard accounting rules and corporate tax law.

4. Cryptocurrency Mining in Slovenia: What You Need to Know

Cryptocurrency mining is not restricted in Slovenia, but income from mining is considered business income and is therefore taxable. This includes rewards from validating transactions and any additional income from mining operations. Both individuals and legal entities must comply with Slovenian tax regulations.

5. Timeline of the development of cryptocurrency regulation in Slovenia

Here is a timeline highlighting the evolution of cryptocurrency regulations in Slovenia:

- 2013:The Slovenian Financial Administration has issued guidelines stating that income from cryptocurrency transactions should be taxed.

- 2017:The Slovenian Financial Administration has provided more detailed guidelines on cryptocurrency taxation, depending on factors such as the status of the trader and the type of transaction.

- 2023:The EU adopted the Markets in Crypto-Assets (MiCA) Regulation, establishing a uniform regulatory framework for crypto-assets, their issuers and service providers across the EU.

Endnote

Slovenia’s approach to the cryptocurrency sector is commendable, reflecting its optimistic view of the future of cryptocurrencies. The country’s balanced regulatory framework supports cryptocurrency innovation while protecting users’ rights and preventing illegal activities. Recent developments demonstrate Slovenia’s commitment to continually improving its regulatory environment. Slovenia’s cryptocurrency regulatory framework sets a positive example for other nations navigating the evolving cryptocurrency landscape.

Read also : Hong Kong Cryptocurrency Regulations 2024

Regulation

A Blank Sheet for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

photo by Shubham Dhage on Unsplash

As the cryptocurrency landscape continues to evolve, the need for clear regulation has never been more pressing.

With Vice President Kamala Harris now leading the charge on digital asset regulation in the United States, this represents a unique opportunity to start fresh. This fresh start can foster innovation and protect consumers. It can also pave the way for widespread adoption across industries, including real estate agencies, healthcare providers, and online gaming platforms like these. online casinos ukAccording to experts at SafestCasinoSites, these platforms come with benefits such as bonus offers, a wide selection of games, and various payment methods. Ultimately, all this increase in adoption could propel the cryptocurrency market forward.

With this in mind, let’s look at the current state of cryptocurrency regulation in the United States, a complex and confusing landscape. Multiple agencies, including the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), and the Financial Crimes Enforcement Network (FinCEN), have overlapping jurisdictions, creating a fragmented regulatory environment. This lack of clarity has stifled innovation as companies are reluctant to invest in the United States, fearing regulatory repercussions. A coherent and clear regulatory framework is urgently needed to realize the full potential of cryptocurrencies in the United States.

While the US struggles to find its footing, other countries, such as Singapore and the UK, are actively looking into the cryptocurrency sector by adopting clear and supportive regulatory frameworks. This has led to a brain drain, with companies choosing to locate in more conducive environments.

Vice President Kamala Harris has a unique opportunity to change that narrative and start over. Regulation of cryptocurrencies. By taking a comprehensive and inclusive approach, it can help create a framework that balances consumer protection with innovation and growth. The time has come for clear and effective regulation of cryptocurrencies in the United States.

Effective regulation of digital assets is essential to foster a safe and innovative environment. The key principles guiding this regulation are clarity, innovation, global cooperation, consumer protection, and flexibility. Clear definitions and guidelines eliminate ambiguity while encouraging experimentation and development to ensure progress. Collaboration with international partners establishes consistent standards, preventing regulatory arbitrage. Strong safeguards protect consumers from fraud and market abuse, and adaptability allows for evolution in response to emerging trends and technologies, striking a balance between innovation and protection.

The benefits of effective cryptocurrency regulation are multiple and far-reaching. By establishing clear guidelines, governments can attract investors and mainstream users, driving growth and adoption. This can, in turn, position countries like the United States as global leaders in fintech and innovation. Strong safeguards will also increase consumer confidence in digital assets and related products, increasing economic activity.

A thriving crypto industry can contribute significantly to GDP and job creation, which has a positive impact on the overall economy. Furthermore, effective regulation has paved the way for the growth of many businesses such as tech startups, online casinos, and pharmaceutical companies, demonstrating that clear guidelines can open up new opportunities without stifling innovation. This is a great example of how regulation can allay fears of regressive policies, even if Kamala Harris does not repeal the current progressive approach. By adopting effective regulation, governments can create fertile ground for the crypto industry to thrive, thereby promoting progress and prosperity.

Regulation

South Korea Imposes New ‘Monitoring’ Fees on Cryptocurrency Exchanges

Big news! The latest regulatory changes in South Korea are expected to impact major cryptocurrency exchanges like Upbit and Bithumb. Under the updated regulations, these platforms will now have to pay monitoring fees, which could cause problems for some exchanges.

Overview of new fees

In the latest move to regulate cryptocurrencies, the Financial Services Commission announced on July 1 the revised “Enforcement Order of the Act on the Establishment of the Financial Services Commission, etc.” update “Regulations on the collection of contributions from financial institutions, etc.” According to local legislation newsThe regulations require virtual asset operators to pay supervisory fees for inspections conducted by the Financial Supervisory Service starting next year. The total fees for the four major exchanges are estimated at around 300 million won, or about $220,000.

Apportionment of costs

Upbit, which holds a dominant market share, is expected to bear more than 90% of the total fee, or about 272 million won ($199,592) based on its operating revenue. Bithumb will pay about 21.14 million won ($155,157), while Coinone and GOPAX will contribute about 6.03 million won ($4,422) and 830,000 won ($608), respectively. Korbit is excluded from this fee due to its lower operating revenue.

Impact on the industry

The supervision fee will function similarly to a quasi-tax for financial institutions subject to inspections by the Financial Supervisory Service. The new law requires any company with a turnover of 3 billion won or more to pay the fee.

In the past, fees for electronic financial companies and P2P investment firms were phased in over three years. However, the taxation of virtual asset operators has been accelerated, reflecting the rapid growth of the cryptocurrency market and increasing regulatory scrutiny.

Industry reactions

The rapid introduction of the fee was unexpected by some industry players, who had expected a delay. Financial Supervisory Service officials justified the decision by citing the creation of the body concerned and the costs already incurred.

While larger exchanges like Upbit and Bithumb can afford the cost, smaller exchanges like Coinone and GOPAX, which are currently operating at a loss, could face an additional financial burden. This is part of a broader trend of declining trading volumes for South Korean exchanges, which have seen a 30% drop since the new law went into effect.

-

Regulation12 months ago

Regulation12 months agoRipple CTO and Cardano founder clash over XRP’s regulatory challenges ⋆ ZyCrypto

-

Regulation10 months ago

Regulation10 months agoNancy Pelosi Considers Supporting Republican Crypto Bill FIT21 – London Business News

-

Videos12 months ago

Videos12 months agoCryptocurrency News: Bitcoin, ETH ETF, AI Crypto Rally, AKT, TON & MORE!!

-

Regulation12 months ago

Regulation12 months agoBitcoin’s future is ‘bleak’ and ripe for regulation, says lead developer

-

News9 months ago

News9 months agoAave Price Increases Following Whales Accumulation and V3.1 Launch

-

Regulation9 months ago

Regulation9 months agoSouth Korea Imposes New ‘Monitoring’ Fees on Cryptocurrency Exchanges

-

Regulation9 months ago

Regulation9 months agoA Blank Sheet for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation9 months ago

Regulation9 months agoCryptocurrency Regulations in Slovenia 2024

-

News11 months ago

News11 months agoThe trader earned $46 million with PEPE after reaching a new ATH

-

Regulation11 months ago

Regulation11 months agoCrypto needs regulation to thrive: Tyler Cowen

-

Blockchain11 months ago

Blockchain11 months agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Blockchain11 months ago

Blockchain11 months agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto