Ethereum

Why are Ethereum whales disappearing?

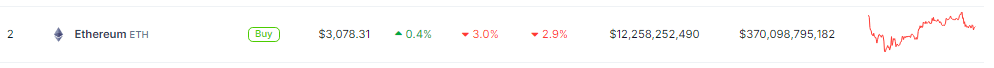

Ethereum (ETH), the world’s second-largest cryptocurrency, continues to struggle with uncertainty after a sharp price decline. Investors are on edge, with whales exiting their positions and market sentiment oscillating between fear and a glimmer of hope.

Ethereum price struggles to regain its footing

The price of Ethereum has been on a roller coaster ride these past few months. After hitting new highs in late 2021, the cryptocurrency fell dramatically, leaving investors reeling. The recovery has been slow, with Ethereum currently hovering around $3,077, far from its peak.

Source: Coingecko

This lackluster performance is causing concern among investors, particularly large holders known as whales. Recent data from Lookonchain paints a worrying picture: a whale that bought ETH a year ago is cashing out, pocketing a tidy $16 million profit. This whale’s actions highlight a potential exodus of large investors, which could drive the price down further.

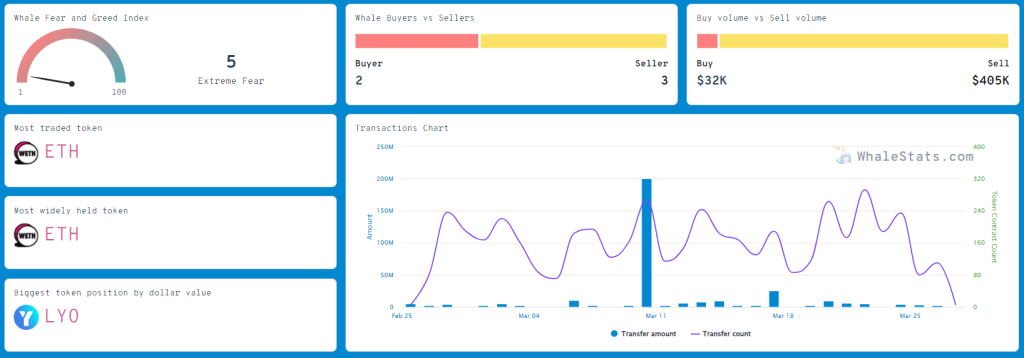

Fear grips Ethereum whales

WhaleStats, a platform that tracks large cryptocurrency holders, reveals that Ethereum whales are experiencing extreme fear. The BSC Chain Ethereum Whale Fear and Greed Index, a measure of investor sentiment, is currently in the “extreme fear” zone. This suggests that whales are reluctant to take significant action, waiting for the market to stabilize before deploying their capital.

Source: WhaleStats

If Ethereum remains the most popular token among whales, their apprehension is palpable. They monitor market movements closely, waiting for a clear signal before jumping in.

Opinions divided on the future of Ether

The future of Ethereum remains a topic of debate among crypto analysts. Ashcrypto, a renowned analyst, believes in a potential rebound in the third quarter of this year. Based on historical patterns from 2020 and 2021, Ashcrypto predicts a price rise towards $4,000.

See more

ETHEREUM PRICE UPDATE

– Similar fractal in Q4 2020

– A breakout could occur in the third quarter of 2024, according to the historical model

Once it breaks out, the 100x altseason will begin with ETH heading towards $15,000. pic.twitter.com/F1Zr6mQeHB

– Ash Crypto (@Ashcryptoreal) May 6, 2024

Data from IntoTheBlock reveals a strong correlation between Ethereum price and significant trading volume. The recent decline in large transactions coincides with the price decline, suggesting that whales play a critical role in influencing Ethereum’s trajectory.

Total crypto market cap currently at $2.28 trillion. Chart: TradingView

Overview of ETH price developments

Meanwhile, with its next target of $3,090, Ether is expected to continue its downtrend correction, demonstrating further bearish bias when it settles below $3,120 again.

If the price exceeds $3,100, it will end the planned decline and attempt to regain the main positive trend. A move below the EMA50 would support the continuation of the recommended negative wave.

Is Ethereum headed for a revival?

The answer remains unclear. Although some analysts predict a resurgence, current whale sales and market sentiment of fear pose significant challenges. The coming months will be crucial for Ethereum as it navigates a volatile market and attempts to regain investor confidence.

Featured image from Hakai Magazine, chart from TradingView