News

Why Bitcoin and Crypto Stocks Rise or Fall in the First Half of 2024

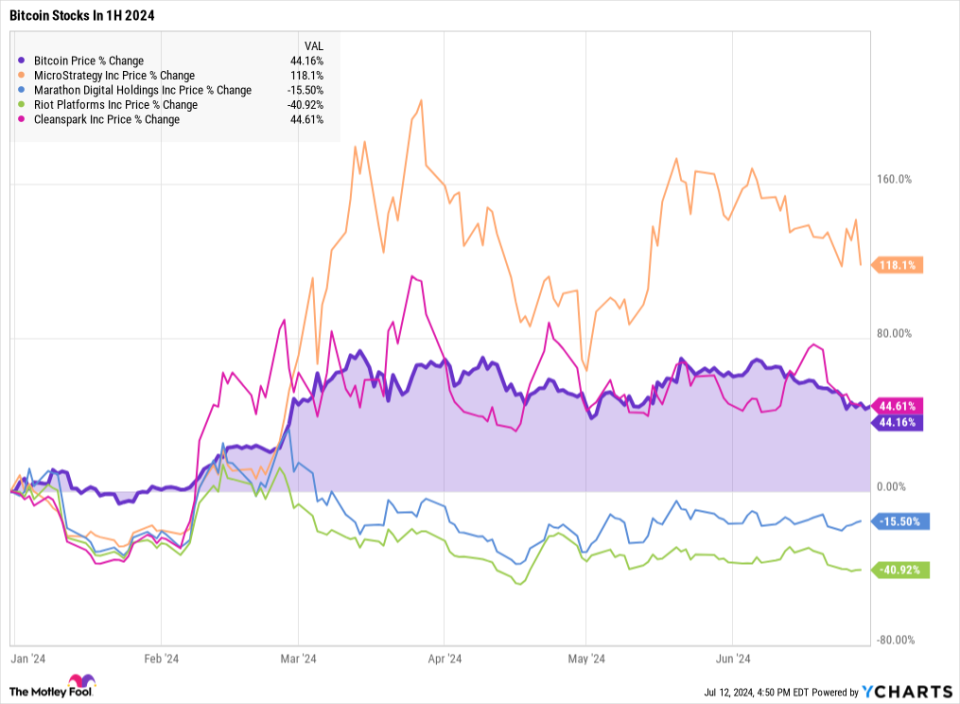

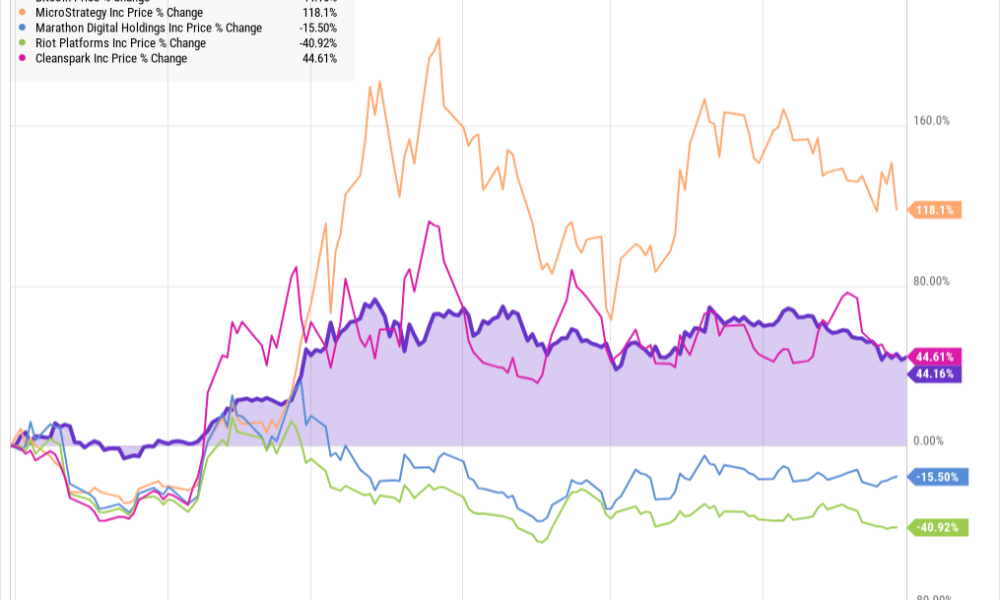

THE Bitcoin (CRYPTO: BTC) cryptocurrency has seen solid gains in the first half of 2024, starting with the introduction of find bitcoin exchange traded funds (ETFs) in January. Bitcoin mining rewards were cut in half on April 19, which didn’t immediately move the cryptocurrency price, but it did set the stage for another four-year boom-bust cycle. By the end of June, it had achieved a solid 44.2% gain according to data from S&P Global Market Intelligence.

Then, there is Microstrategy (NASDAQ: MSTR). The enterprise software company decided to ride the Bitcoin wave in the most amplified way four years ago. MicroStrategy’s balance sheet contained $7.5 billion in Bitcoin but only $81 million in cash by the end of March. Mirroring Bitcoin’s rise with an extra dose of adrenaline, MicroStrategy is up a whopping 118.1% in six months.

Meanwhile, most cryptocurrency miners did not share the same bullish fate. The reward halving had an immediate effect on their financial results, and major miners headed in different directions. Digital Marathon Entries (NASDAQ: MARA) saw a price drop of 15.5%, while Riot platforms (NASDAQ: RIOT) has lost 40.9% of its market value. Highlighting the complex nature of today’s cryptocurrency market, Clean spark (NASDAQ: CLSK) managed to keep pace with Bitcoin’s gains, pocketing a 44.6% return.

Bitcoin Price Chart

Same fundamental news, different market reactions

Why have these cryptocurrency-related investments taken different directions? Their operations are quite different and market makers are paying attention to these unique qualities.

Clean spark

In the first half of the year, CleanSpark acquired a total of 13 new mining facilities from other companies, spanning the U.S. from Georgia to Wyoming.

Additionally, the all-American Bitcoin miner also swept Wall Street consensus estimates in its first-quarter earnings report in February and its second-quarter earnings update in May. The company turned a profit in both earnings reports, both in terms of free cash flow and adjusted earnings per share.

With proven profitability, a debt-free balance sheet, $323 million in cash reserves, and a similar amount of Bitcoin in its portfolio, CleanSpark appears poised to weather the low production rates of this reward halving cycle.

Not surprisingly, this success story has led to rising stock prices.

Marathon

Marathon experienced the same halving rewards as CleanSpark and has begun its own production facility purchase spree. The company currently has 31.5 exahash per second (EH/s) of mining equipment installed, aimed at the Bitcoin mining business. A much smaller fleet with a capacity of 0.6 EH/s is mining the smallest Caspa cryptocurrency, diversifying Marathon’s crypto operations a bit.

The story continues

The crypto miner is also exploring international production beyond its Texas facilities, running a small test project in Finland and an energy network partnership in Kenya. Marathon burns more cash than it generates, and its Bitcoin holdings outweigh its cash balance by a ratio of 4 to 1.

Investors believe this is a riskier structure, making Marathon shares more vulnerable to economic challenges.

Riot platforms

Riot Platforms operates a smaller Bitcoin mining operation than Marathon or CleanSpark. Its average production capacity stands at 11.4 EH/s, aiming for 31 EH/s by the end of 2024. Both Marathon and CleanSpark are targeting 50 EH/s capacity at the same timeframe.

This company supplements its Bitcoin revenue with energy credits earned by reducing or stopping its mining operations when the Texas power grid needs a boost. The company is involved in a stock-swap takeover attempt of a smaller rival Bit Farms (NASDAQ: BITF), acquiring a 14% ownership stake as Bitfarms adopted a “poison pill” policy.

The acquisition is still uncertain and investors generally hate uncertainty, so Riot Platforms stock price action isn’t going to impress anyone in 2024.

Microstrategy

MicroStrategy is a different story. The company doesn’t operate Bitcoin mining machines, so it doesn’t care much about lower mining rewards.

Founder and Chairman Michael Saylor’s company is very concerned about the price of Bitcoin, now and in the long term, as nearly all of its cash reserves have been converted into Bitcoin holdings. The company also continues to buy more Bitcoin at every opportunity.

The purchases were funded by MicroStrategy software company profits, additional stock sales, new debt, and, in a short-term test, even a loan secured by some of the company’s Bitcoin holdings. This coin-buying strategy magnifies Bitcoin’s gains when times are good, but it also exposes investors to greater risk when Bitcoin prices are falling.

This year the cryptocurrency is on the rise, so the MicroStrategy stock price is benefiting from the cryptocurrency trend.

How Bitcoin Halving Increases Cryptocurrency Mining Profits

Bitcoin’s mining reward halving makes it harder to run a profitable mining operation, at least for a while. This hard-coded four-year cycle is designed to limit the supply of new coins while the cryptocurrency builds real-world demand.

The fundamental laws of supply and demand dictate rising prices in this scenario, and the Bitcoin price chart has shown this pattern for each of the first three halvings. History doesn’t repeat itself, but it often echoes familiar patterns, and the fourth reward halving cycle looks set to send Bitcoin prices soaring in the next year or so.

This predictable trend is the foundation of Michael Saylor’s Bitcoin strategy. It also eliminates the weakest hands from the expensive Bitcoin mining industry when rewards are low and the Bitcoin price has not yet begun its upward trend. Riot’s attempt to acquire Bitfarms is an ambitious but risky effort to capitalize on the target company’s financial weakness before the cryptocurrency chart starts to rise again.

There is one clear takeaway for investors from Bitcoin trends in early 2024: Understanding the cyclical nature of Bitcoin and the strategic moves of the major players in the surrounding industry can provide a significant edge. Keep an eye on the players that thrive under pressure, because they are the ones likely to shine when the market rebounds. The presence of spot Bitcoin ETFs should boost and support the current cycle, thanks to a strong influx of money from institutional investors.

Should You Invest $1,000 in MicroStrategy Now?

Before buying MicroStrategy stock, consider the following:

The Motley Fool Stock Advisor analyst team has just identified what they believe to be the 10 best stocks for investors to buy now… and MicroStrategy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you have invested $1,000 at the time of our recommendation, you would have $791,929!*

Stock Advisor provides investors with an easy-to-follow success model that includes a portfolio building guide, regular analyst updates, and two new stock picks each month. The Stock Advisor service has more than quadrupled the S&P 500’s comeback since 2002*.

*Stock Advisor returns as of July 8, 2024

Anders Bylund has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

Why Bitcoin and Crypto Stocks Rise or Fall in the First Half of 2024 was originally published by The Motley Fool