Blockchain

Will Bitcoin Surpass Predictions and Soar to $300,000 by 2025?

At the time of writing, Bitcoin is in a stable bullish phase, repelling attempts at lower lows despite the roughly 20% drop seen in June.

While there is hope that prices will tend to rise in June, one analyst thinks BTC is walking a tightrope. For buyers, this means that BTC will defy its historical trends seen over the past five years by printing green by September.

Will Bitcoin Beat the Odds?

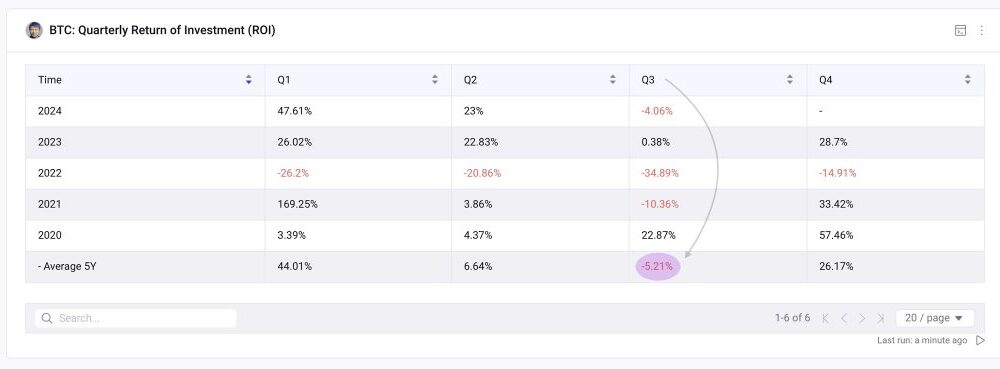

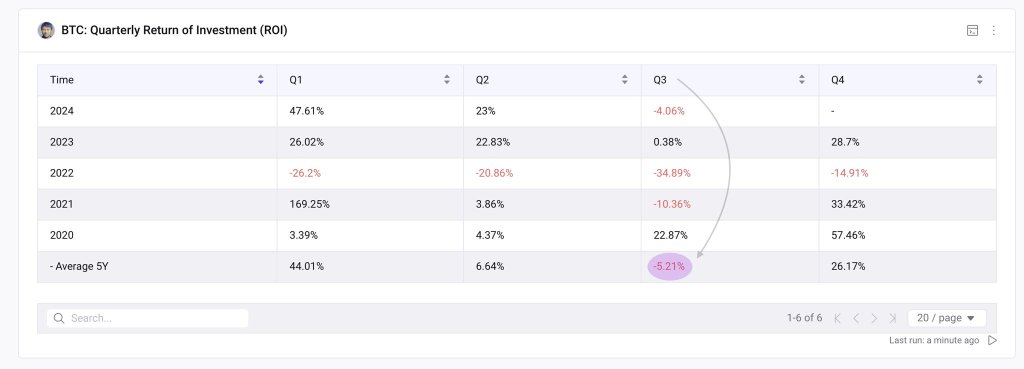

Aggregate price data over the past five years paints a worrisome picture for the third quarter of 2023. In a post shared According to one analyst, historical data shows that Bitcoin often experiences a decline in the third quarter, recording an average return on investment (ROI) of -5.21%.

If this sets a precedent, then it means that while BTC is stable at the time of writing, the coin will most likely end up suffering losses lower than current rates.

Looking at the price charts, it is clear that buyers are in control, mainly due to Q1 2024 earnings. Then, prices rose to all-time highs before correcting, falling to $56,800.

While this line has not been broken, bulls have struggled to find momentum, while bears have been relentless, forcing prices lower on numerous occasions.

BTC at $300K? On-chain Activity and Institutional Adoption on the Rise

Despite the historically bearish trend in Q3, some analysts remain optimistic. Considering X, an analyst thinks BTC to soar to $300,000 by 2025 based on “power law” theory. This forecast is almost 5 times higher than spot rates, which is overly optimistic.

According to the analyst, according to the “power law” theory, fundamentals play a crucial role. When you consider a predictable growth model for Bitcoin based on its network activity, then the only way out, the analyst said, is up.

To further support this view, the analyst said that Bitcoin prices have been following a power law for over a decade. This means that the coin’s intrinsic value is independent of market hype.

In addition to this, several other metrics support the potential for continued growth. For example, data from IntoTheBlock reveals that the number of active Bitcoin addresses continues to increase, reaching levels not seen since mid-April.

An ETF analyst, Eric Balchunas, She said Inflows into spot Bitcoin exchange-traded funds (ETFs) remain strong despite recent price declines. This means investors expect prices to tend to rise despite short-term price fluctuations.

As Institutions Float Into Spot Bitcoin ETFs, Other Data show that the top 25 hedge funds in United States now they hold BTC in their wallets.

Feature image from DALLE, chart from TradingView