News

The ultimate cryptocurrency to buy with $1,000

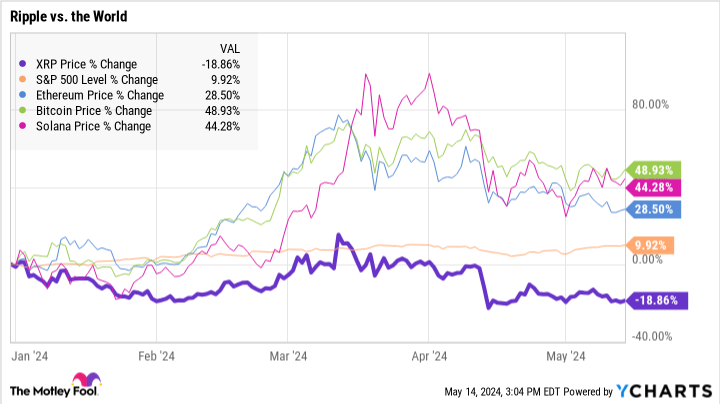

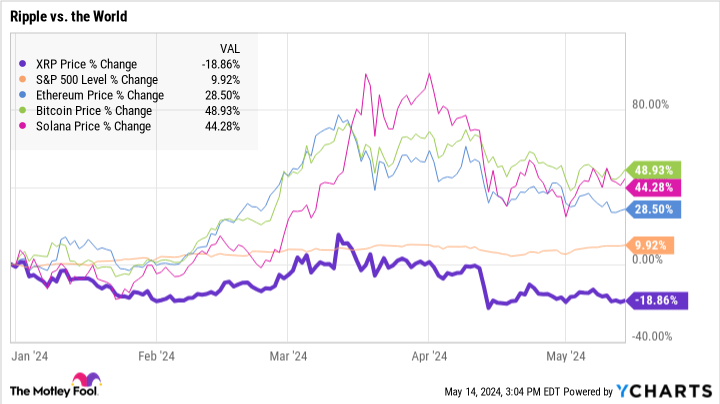

The cryptocurrency market is expected to grow strongly in 2024. Ethereum (CRYPTO:ETH) has gained nearly 30% year to date, easily surpassing a 10% gain in S&P500 stock market index. Bitcoin (CRYPTO: BTC) e Solana (CRYPTO:SOL) have increased by approximately 45% over the same period.

But Ripple (CRYPTO:XRP) didn’t get that memo. The international payment system’s XRP token is down by almost 20%:

XRP price chart

I think that’s a big mistake. Whether you are an experienced cryptocurrency investor or want to purchase your first digital currency, XRP looks like a fantastic purchase right now. If you have $1,000 to invest in a crypto name today, you should consider purchasing around 2,000 XRP tokens.

Here because.

Legal challenges and market perception

If you’ve heard of Ripple, it’s probably because of the legal challenge it’s facing.

THE US Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs and some of its top executives in December 2020. The lawsuit alleged that the launch of XRP raised $1.3 billion in cash investments by creating a new security, which was not registered with the SEC as you would with a new stock, bond or convertible debt.

Ripple does not want to settle the case, aiming to set a legal precedent for the entire cryptocurrency industry. In CEO Brad Garlinghouse’s mind, XRP was never a security and should never have required SEC registration. The XRP token and the underlying Ripple payment network do not imply ownership by Ripple or any other entity, and the token fails the crucial “Howey test.”

Howey is a legal principle established in a 1946 Supreme Court case. It tests whether a transaction is an “investment contract” and, therefore, should be regulated as collateral. It involves four criteria: investment of money in a joint venture with the expectation of profits solely from the efforts of others.

It’s a high-stakes challenge. The SEC is seeking nearly $2 billion in damages. In exchange, Ripple believes a $10 million fine would be appropriate for missing documentation related to the offering of XRP to institutional investors. Judge Analisa Torres dismissed most of the SEC’s complaints, but the institutional investors’ claims went to a jury trial expected to conclude in 2024.

The ups and downs of this groundbreaking courtroom drama often cause the prices of XRP tokens to rise or fall. In fact, the legal din has actually drowned out the market-moving effects of Ripple’s actual trading operations.

Ripple’s resilience and future potential

Let’s imagine the SEC wins what’s left of its registration claims. A package of $2 billion in damages and interest payments would hurt Ripple, but that shouldn’t be the end of the story.

The story continues

XRP’s market capitalization stands at $27.7 billion today. The RippleNet payment service partners with local banks in more than 100 countries around the world, and each bank connection adds a modest amount of funds to handle transactions. Last month, Ripple announced a 100% cash-backed dollar-based stablecoin, providing a financial pledge between XRP and Ethereum (CRYPTO: ETH). This is another sign of substantial cash resources in Ripple’s pockets, bank accounts, and couch cushions.

And there’s more buzz in Ripple’s hood. A popular cryptocurrency exchange began trading XRP options in March, increasing the financial flexibility and credibility of the Ripple network. RippleNet is building new connections with partners in places like Japan and South Korea.

Long story short, Ripple and XRP are making significant progress, and the network for fast, low-cost international payments is more useful than ever. Removing $2 billion from corporate books might slow Ripple a bit, but the pace continues.

Again, this is the worst case scenario. I’m no lawyer, but the signs I saw coming out of that New York courtroom probably won’t lead Judge Torres and the jury to that extreme conclusion.

It’s time to act

So, if XRP tokens are cheap due to legal pressure from the SEC, I am more than happy to buy the cryptocurrency while it is discounted.

The current price represents a fantastic buying opportunity for a token that is not only deeply integrated into a global payment network, but also poised to benefit from a potential legal victory. Once the dust settles, Ripple’s strong partnerships, innovative solutions, and growing market presence should generate significant value for XRP holders. Yes, even if the SEC gets everything it wants from the securities registration complaint.

Investing $1,000 in XRP today could yield impressive returns as the legal drama eases and Ripple continues to revolutionize the financial sector.

Should You Invest $1,000 in XRP Right Now?

Before you buy shares in XRP, consider this:

The analyst team at Motley Fool Stock Advisor has just identified what they believe is the 10 best stocks for investors to buy now… and XRP was not one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia you created this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $559,743!*

Stock Advisor provides investors with an easy-to-follow model of success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. The stock advisory service has more than quadrupled the return of the S&P 500 index since 2002*.

*Equity advisor will return starting May 13, 2024

Anders Bylund has positions in Bitcoin, Ethereum, Solana and XRP. The Motley Fool has positions and recommends Bitcoin, Ethereum, Solana and XRP. The Motley Fool has a disclosure policy.

The ultimate cryptocurrency to buy with $1,000 was originally published by The Motley Fool