News

The ultimate cryptocurrency to buy with $1,000

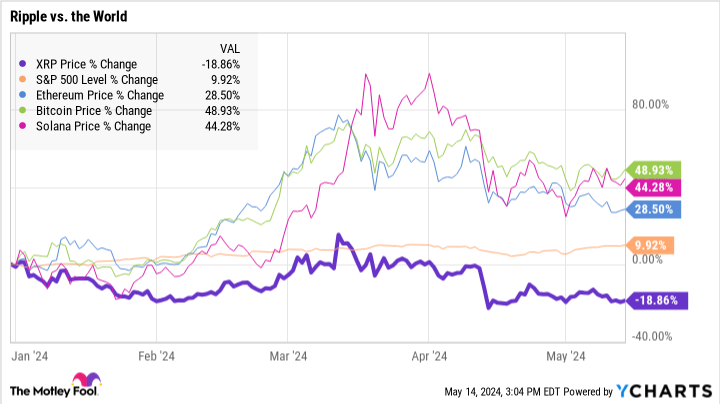

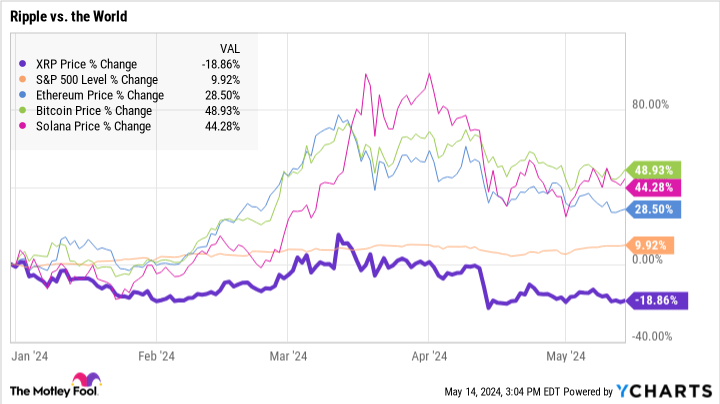

The cryptocurrency market is expected to grow strongly in 2024. Ethereum (CRYPTO:ETH) has gained nearly 30% year to date, easily surpassing a 10% gain in S&P500 stock market index. Bitcoin (CRYPTO: BTC) e Solana (CRYPTO:SOL) have increased by approximately 45% over the same period.

But Ripple (CRYPTO:XRP) didn’t get that memo. The international payment system’s XRP token is down by almost 20%:

XRP price chart

I think that’s a big mistake. Whether you are an experienced cryptocurrency investor or want to purchase your first digital currency, XRP looks like a fantastic purchase right now. If you have $1,000 to invest in a crypto name today, you should consider purchasing around 2,000 XRP tokens.

Here because.

Legal challenges and market perception

If you’ve heard of Ripple, it’s probably because of the legal challenge it’s facing.

THE US Securities and Exchange Commission (SEC) filed a lawsuit against Ripple Labs and some of its top executives in December 2020. The lawsuit alleged that the launch of XRP raised $1.3 billion in cash investments by creating a new security, which was not registered with the SEC as you would with a new stock, bond or convertible debt.

Ripple does not want to settle the case, aiming to set a legal precedent for the entire cryptocurrency industry. In CEO Brad Garlinghouse’s mind, XRP was never a security and should never have required SEC registration. The XRP token and the underlying Ripple payment network do not imply ownership by Ripple or any other entity, and the token fails the crucial “Howey test.”

Howey is a legal principle established in a 1946 Supreme Court case. It tests whether a transaction is an “investment contract” and, therefore, should be regulated as collateral. It involves four criteria: investment of money in a joint venture with the expectation of profits solely from the efforts of others.

It’s a high-stakes challenge. The SEC is seeking nearly $2 billion in damages. In exchange, Ripple believes a $10 million fine would be appropriate for missing documentation related to the offering of XRP to institutional investors. Judge Analisa Torres dismissed most of the SEC’s complaints, but the institutional investors’ claims went to a jury trial expected to conclude in 2024.

The ups and downs of this groundbreaking courtroom drama often cause the prices of XRP tokens to rise or fall. In fact, the legal din has actually drowned out the market-moving effects of Ripple’s actual trading operations.

Ripple’s resilience and future potential

Let’s imagine the SEC wins what’s left of its registration claims. A package of $2 billion in damages and interest payments would hurt Ripple, but that shouldn’t be the end of the story.

The story continues

XRP’s market capitalization stands at $27.7 billion today. The RippleNet payment service partners with local banks in more than 100 countries around the world, and each bank connection adds a modest amount of funds to handle transactions. Last month, Ripple announced a 100% cash-backed dollar-based stablecoin, providing a financial pledge between XRP and Ethereum (CRYPTO: ETH). This is another sign of substantial cash resources in Ripple’s pockets, bank accounts, and couch cushions.

And there’s more buzz in Ripple’s hood. A popular cryptocurrency exchange began trading XRP options in March, increasing the financial flexibility and credibility of the Ripple network. RippleNet is building new connections with partners in places like Japan and South Korea.

Long story short, Ripple and XRP are making significant progress, and the network for fast, low-cost international payments is more useful than ever. Removing $2 billion from corporate books might slow Ripple a bit, but the pace continues.

Again, this is the worst case scenario. I’m no lawyer, but the signs I saw coming out of that New York courtroom probably won’t lead Judge Torres and the jury to that extreme conclusion.

It’s time to act

So, if XRP tokens are cheap due to legal pressure from the SEC, I am more than happy to buy the cryptocurrency while it is discounted.

The current price represents a fantastic buying opportunity for a token that is not only deeply integrated into a global payment network, but also poised to benefit from a potential legal victory. Once the dust settles, Ripple’s strong partnerships, innovative solutions, and growing market presence should generate significant value for XRP holders. Yes, even if the SEC gets everything it wants from the securities registration complaint.

Investing $1,000 in XRP today could yield impressive returns as the legal drama eases and Ripple continues to revolutionize the financial sector.

Should You Invest $1,000 in XRP Right Now?

Before you buy shares in XRP, consider this:

The analyst team at Motley Fool Stock Advisor has just identified what they believe is the 10 best stocks for investors to buy now… and XRP was not one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia you created this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you would have $559,743!*

Stock Advisor provides investors with an easy-to-follow model of success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks every month. The stock advisory service has more than quadrupled the return of the S&P 500 index since 2002*.

*Equity advisor will return starting May 13, 2024

Anders Bylund has positions in Bitcoin, Ethereum, Solana and XRP. The Motley Fool has positions and recommends Bitcoin, Ethereum, Solana and XRP. The Motley Fool has a disclosure policy.

The ultimate cryptocurrency to buy with $1,000 was originally published by The Motley Fool

News

Cryptocurrency Price August 1: Bitcoin Dips Below $65K; Solana, XRP Down Up To 8%

Major cryptocurrencies fell in Thursday trading following the Federal Reserve’s decision to keep its key interest rate unchanged. Overnight, the U.S. Federal Reserve kept its key interest rate at 5.25-5.5% for the eighth consecutive time, as expected, while also signaling the possibility of a rate cut at its next meeting in September. The unanimous decision by the Federal Open Market Committee reflects a continued wait-and-see approach as it monitors inflation trends.

CoinSwitch Markets Desk said: “Bitcoin has fallen below $65,000 after the US Federal Reserve announced it would keep interest rates unchanged. However, with markets now anticipating rate cuts at the next Federal Reserve meeting in September, the outlook for a Bitcoin rally by the end of the year has strengthened.”

Meanwhile, CoinDCX research team said: “The crypto market has plunged after the Fed decision. Tomorrow’s US unemployment rate announcement is expected to induce more volatility, with the ‘actual’ figure coming in higher than the ‘expected’ one, which is positive for cryptocurrencies.”

At 12:21 pm IST, Bitcoin (BTC) was down 3.2% at $64,285, while Ethereum was down nearly 4.5% at $3,313. Meanwhile, the global market cryptocurrency The market capitalization fell 3.6% to around $2.3 trillion in the last 24 hours.

“Bitcoin needs to clear its 200-day EMA at $64,510 to consolidate further. Otherwise, a retest of $62,000 could be in the cards,” said Vikram Subburaj, CEO of Giottus.

Altcoins and meme coins, such as BNB (3%), Solana (8%), XRP (5.7%), Dogecoin (5%), Cardano (4.6%), Avalanche (4.3%), Shiba Inu (3.8%), Polkadot (3.4%), and Chainlink (4%) also saw declines.

The volume of all stablecoins is now $71.64 billion, which is 92.19% of the total cryptocurrency market volume in 24 hours, according to data available on CoinMarketCap. Bitcoin’s dominance is currently 54.99%. BTC volume in the last 24 hours increased by 23.3% to $35.7 billion.

(Disclaimer: Recommendations, suggestions, opinions and views provided by experts are personal. They do not represent the views of the Economic Times)

(You can now subscribe to our ETMarkets WhatsApp Channel)

News

Altcoins WIF, BONK, RUNE, JUP Down 10% While Bitcoin Drops 4%

Altcoins dogwifhat, Bonk, THORChain, and Jupiter have suffered losses of more than 10%, while Bitcoin is down 4% in the last 24 hours.

After a period of relative calm yesterday, July 31, Bitcoin (BTC) price action has seen a drastic change as the cryptocurrency dropped by more than $3,500, bringing its value to $63,300. At the same time, altcoins mirrored this trend, with the total value of liquidated positions rising to nearly $225 million over the course of the day.

Initially, the week started on a positive note for Bitcoin, which reached its highest point since early June, hitting $70,000. However, this peak was short-lived, as it was quickly rejected, leading to a substantial decline, with Bitcoin falling below $65,500.

The cryptocurrency managed to regain some stability, trading comfortably at around $66,800. However, following a Press conference According to Federal Reserve Chairman Jerome Powell, the value of Bitcoin has fallen again to $64,300, down more than 3% in 24 hours.

BTC Price Chart 24 Hours | Source: crypto.news

The recession coincided with a relationship from the New York Times stating that Iran had called for retaliatory measures against Israel following the assassination of Hamas leader Ismail Haniyeh in Tehran, increasing the risk of further conflict in the region.

Meanwhile, on the economic front, the Federal Reserve decided to keep its benchmark interest rates in place, offering little information on a planned September rate cut. Powell also hinted that while no concrete decisions have been made on the September adjustment, there is growing consensus that a rate cut is likely.

Amid Bitcoin’s decline, altcoins have suffered even more significant losses. For example, dogwifhat (Wife) saw a 12.4% drop and (DISGUST) has suffered a 10% drop. Other altcoins such as THORChain (RUNE) also fell by 10%, while Jupiter (JUPITER) and the Ethereum naming service (ENS) decreased by 8% and 9% respectively.

Among the largest-cap cryptocurrencies, the biggest losers are Solana (SOL) with a decrease of 8%, (Exchange rate risk) down 6%, Cardano (ADA) down 4%, and both Ethereum (ETH) and Dogecoin (DOGE) recording a decrease of 4.4%.

Data from CoinGlass indicates that approximately 67,000 traders have been negatively impacted by this increased volatility. BTC positions have seen $61.85 million in liquidations, while ETH positions have faced $61 million. In total, the value of liquidated positions stands at $225.4 million at the time of writing.

News

Riot Platforms Sees 52% Drop in Bitcoin Production in Q2

Bitcoin mining firm Riot Platforms has released its second-quarter financial results, highlighting a decline in cryptocurrency mined due to the recent halving.

Colorado-based Bitcoin (BTC) mining company Riot platforms revealed its second quarter financial results, highlighting a significant reduction in mined cryptocurrencies attributed to the recent halving event that took place in early April.

The company reported total revenue of $70 million for the quarter ended July 31, a decline of 8.7% compared to the same period in 2023. Riot Platforms attributed the revenue decline primarily to a $9.7 million decrease in engineering revenue, which was partially mitigated by a $6 million increase in Bitcoin extraction income.

During the quarter, the company mined 844 BTC, representing a decline of over 50% from Q2 2023, citing the halving event and increasing network difficulty as major factors behind the decline. Riot Platforms reported a net loss of $84.4 million, or $0.32 per share, missing Zacks Research forecast a loss of $0.16 per share.

Halving increases competitive pressure

The Colorado-based firm said the average cost of mining one BTC in the second quarter, including energy credits, rose to $25,327, a remarkable 341% increase from $5,734 per BTC in the same quarter of 2023. Despite this significant increase in production costs, the firm remains optimistic about maintaining competitiveness through recent deals.

For example, following the Recent acquisition Cryptocurrency firm Block Mining, Riot has increased its distributed hash rate forecast from 31 EH/s to 36 EH/s by the end of 2024, while also increasing its 2025 forecast from 40 EH/s to 56 EH/s.

Riot Platforms Hashrate Growth Projections by 2027 | Source: Riot Platforms

Commenting on the company’s financials, Riot CEO Jason Les said that despite the halving, the mining company still managed to achieve “significant operational growth and execution of our long-term strategy.”

“Despite this reduction in production available to all Bitcoin miners, Riot reported $70 million in revenue for the quarter and maintained strong gross margins in our core Bitcoin mining business.”

Jason Les

Following its Q2 financial report, Riot Platforms shares fell 1.74% to $10.19, according to Google Finance data. Meanwhile, the American miner continues to chase Canadian rival Bitfarms, recently acquiring an additional 10.2 million BITF shares, increasing its stake in Bitfarms to 15.9%.

As previously reported by crypto.news, Riot was the first announced a $950 million takeover bid for Bitfarms in late May, arguing that Bitfarms’ founders were not acting in the best interests of all shareholders. They said their proposal was rejected by Bitfarms’ board without substantive engagement.

In response, Bitfarms She said that Riot’s offer “significantly understates” its growth prospects. Bitfarms subsequently implemented a shareholder rights plan, also known as a “poison pill,” to protect its strategic review process from hostile takeover attempts.

News

Aave Price Increases Following Whales Accumulation and V3.1 Launch

Decentralized finance protocol Aave is seeing a significant spike in whale activity as the market looks to recover from the recent crash that pushed most altcoins into key support areas earlier this week.

July 31, Lookonchain shared details indicating that the whales had aggressively accumulated Aave (AAVE) over the past two days. According to the data, whales have withdrawn over 58,848 AAVE worth $6.47 million from exchanges during this period.

In one instance, whale address 0x9af4 withdrew 11,185 AAVE worth $1.23 million from Binance. Meanwhile, another address moved 21,619 AAVE worth over $2.38 million from the exchange and deposited the tokens into Aave.

These withdrawals follow a previous transfer of 26,044 AAVE from whale address 0xd7c5, amounting to over $2.83 million withdrawn from Binance.

AAVE price has surged over 7% in the past 24 hours amid buy-side pressure from these whales. The DeFi token is currently trading around $111 after jumping over 18% in the past week.

Recently, the price of AAVE increased by over 8% after Aave founder Marc Zeller announced a proposed fee change aimed at adopting a buyback program for AAVE tokens.

Aave v3.1 is available

The total value locked in the Aave protocol currently stands at around $22 billion. According to DeFiLlamaApproximately $19.9 billion is on Aave V3, while the V2 chain still holds approximately $1.9 billion in TVL and V1 approximately $14.6 million.

Aave Labs announced Previously, Aave V3.1 was made available on all networks with active Aave V3 instances.

V3.1 features improvements that are intended to improve the overall security of the DeFi protocol. The Aave DAO governance has approved the v3.1 improvements, which also include operational efficiency and usability for the network.

Meanwhile, Aave Labs recently outlined a ambitious roadmap for the projectwith a 2030 vision for Aave V4, among other developments.

-

Regulation11 months ago

Regulation11 months agoRipple CTO and Cardano founder clash over XRP’s regulatory challenges ⋆ ZyCrypto

-

Regulation10 months ago

Regulation10 months agoNancy Pelosi Considers Supporting Republican Crypto Bill FIT21 – London Business News

-

Videos11 months ago

Videos11 months agoCryptocurrency News: Bitcoin, ETH ETF, AI Crypto Rally, AKT, TON & MORE!!

-

Regulation11 months ago

Regulation11 months agoBitcoin’s future is ‘bleak’ and ripe for regulation, says lead developer

-

News8 months ago

News8 months agoAave Price Increases Following Whales Accumulation and V3.1 Launch

-

Regulation8 months ago

Regulation8 months agoSouth Korea Imposes New ‘Monitoring’ Fees on Cryptocurrency Exchanges

-

Regulation8 months ago

Regulation8 months agoA Blank Sheet for Cryptocurrencies: Kamala Harris’ Regulatory Opportunity

-

Regulation8 months ago

Regulation8 months agoCryptocurrency Regulations in Slovenia 2024

-

News11 months ago

News11 months agoThe trader earned $46 million with PEPE after reaching a new ATH

-

Regulation10 months ago

Regulation10 months agoCrypto needs regulation to thrive: Tyler Cowen

-

Blockchain11 months ago

Blockchain11 months agoSolana ranks the fastest blockchain in the world, surpassing Ethereum, Polygon ⋆ ZyCrypto

-

Blockchain10 months ago

Blockchain10 months agoSolana Surpasses Ethereum and Polygon as the Fastest Blockchain ⋆ ZyCrypto